Last month, Novarica published a 2020 update to our Novarica 100 report, which surveys insurer maturity levels in 100 key technology capabilities.

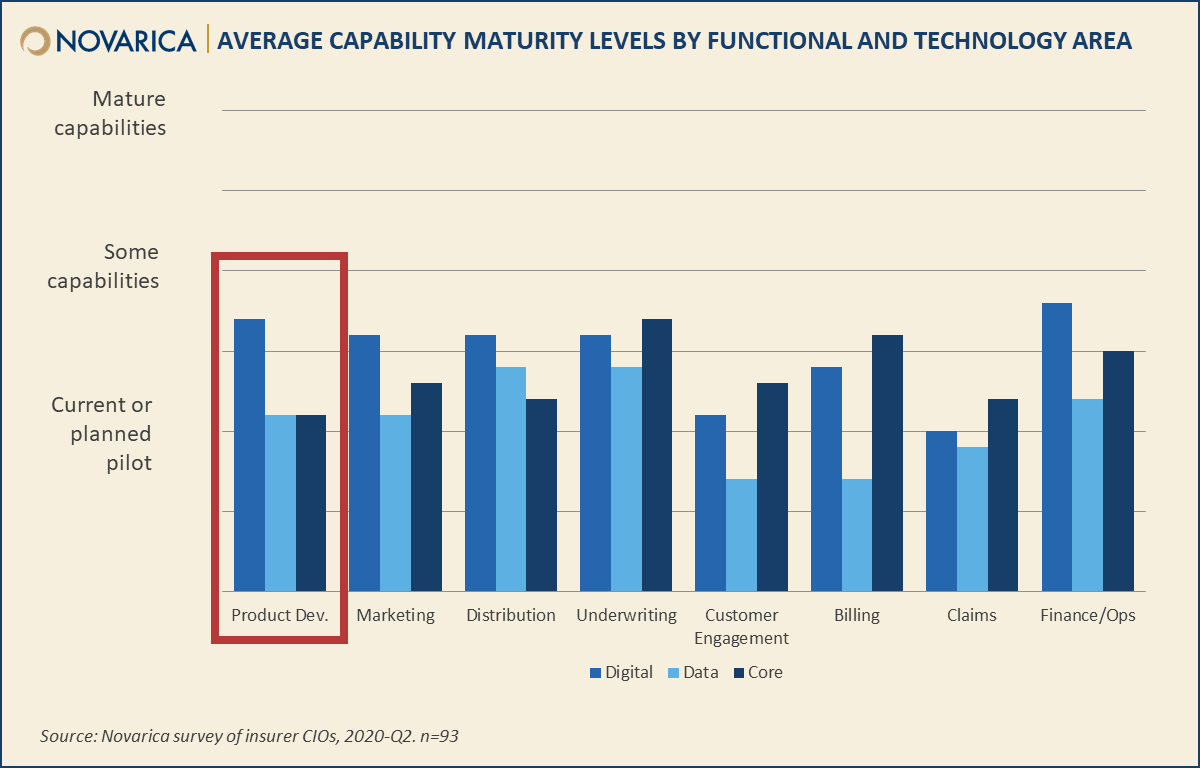

The Novarica 100 Framework includes 12 capabilities in each of eight functional areas: product development, marketing, distribution, underwriting, customer engagement, billing, claims, and finance/operations. These capabilities are divided evenly into four digital, four data, and four core functions. There are also four capabilities specific to IT operations to round out the even 100.

Over the next several weeks, Novarica will take a deep dive into each functional area to examine insurer maturity and what capabilities are the most and least developed. This week we will take a look at Product Development capabilities, which include modeling, actuarial, and the process of bringing new products to market.

Digital capabilities in this area include electronic content management to manage forms, policy language, and other content as well as digital internal workflow to manage the product development process, reviews, approvals, filing status, etc.

Data and analytics capabilities include incorporating customer behavior, customer value, market capacity, and other nontraditional factors and analyses into product design and developing products to maximize the value of external data and models.

Core capabilities include things like integration between product design tools and core rating/ underwriting/policy admin systems to avoid recoding and the ability to assemble and reconfigure products from modular components for ease of launch, change, or addition of new coverage.

Digital product development capabilities are among the most mature across the industry, including large and midsize property/casualty and life/annuity insurers. The use of digital workflows, digital-optimized products, and ECM for better collaboration on product development has become more standard.

Many large insurers are piloting data and analytics capabilities for product development. Large P/C insurers are investing in AI and machine learning. In contrast, large L/A insurers are more likely to be piloting the use of third-party data or analytics-driven design, two capabilities that are becoming table stakes across the industry.

Core capabilities for product development tend to be more distributed and tend to have less pilot activity. However, flexible and agile core systems are becoming more necessary to bring products to market efficiently.

The N100 framework is also available as a self-rating tool for insurers. Novarica clients or Research Council members interested in benchmarking their companies should contact [email protected] to receive a copy.

Add new comment