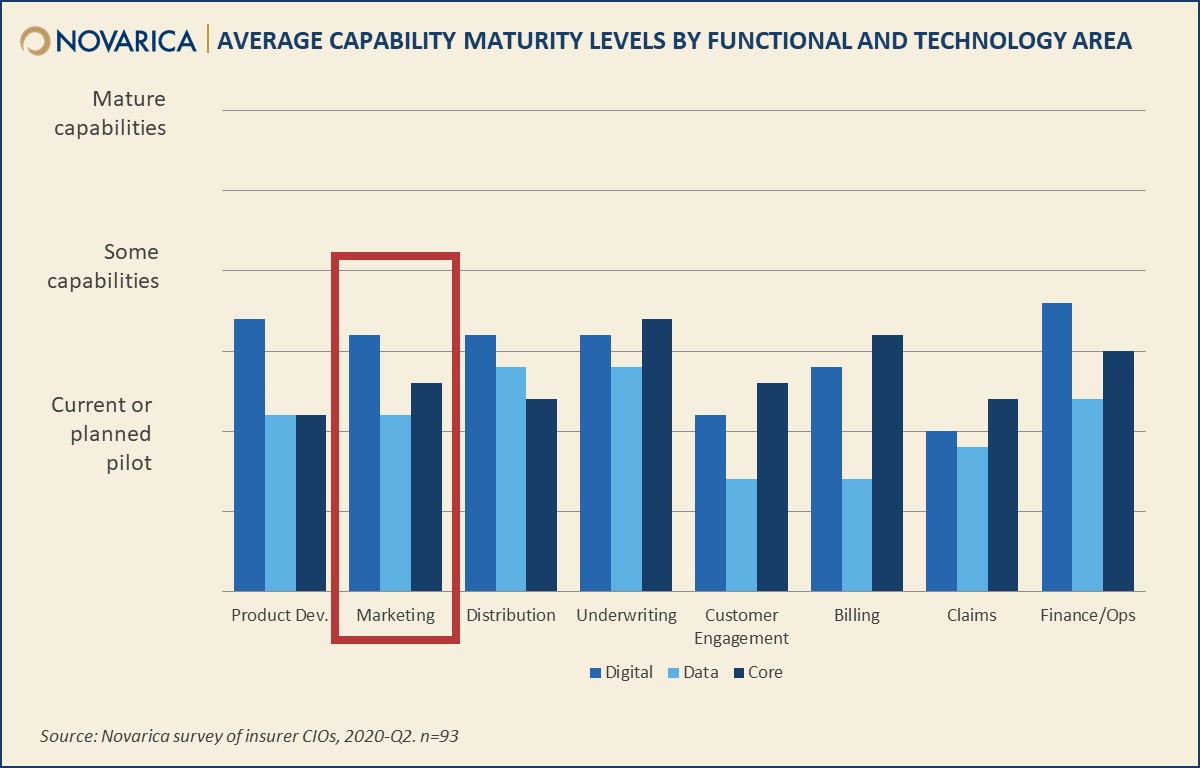

Insurer digital marketing capabilities are among the most mature of all functional and technology areas, according to our recent Novarica 100 benchmarking study. However, insurers could improve their data and core capabilities in this area.

These findings reflect a reality for many insurers: An effective web presence is table stakes, but the level of systems maturity and data integration necessary to coordinate marketing campaigns and target potential customers remain challenging.

The Novarica 100 Framework includes 12 capabilities in eight functional areas: product development, marketing, distribution, underwriting, customer engagement, billing, claims, and finance/operations. These capabilities are divided evenly into four digital, four data, and four core functions. There are also four additional capabilities specific to IT operations, rounding out to an even 100.

Digital capabilities in marketing include social media engagement and websites optimized for users by role (e.g., prospect, policyholder, distributor) or by channel (e.g., mobile).

Data and analytics marketing capabilities include using analytics and external data to target prospects with unique characteristics or favorable risk profiles, as well as using profiling and behavior modeling to understand current and potential customers.

Marketing core capabilities include CCM and CRM systems, as well as insurer ability to orchestrate and manage marketing campaigns. It also includes externalizable APIs for sharing data with partners.

Mobile-optimized and user-centric websites are table stakes for insurers—more than seven of ten insurers have at least some capabilities in this area. Over half of all insurers also report active social media engagement. Recommendation engines are less common but certainly not unheard of.

Marketing data capabilities are less developed, although this is an area where insurers are making progress compared to 2019. Most insurers are only beginning to explore AI and machine learning for marketing.

Core marketing capabilities vary. It’s more common for larger insurers to have mature customer relationship management, but integrated campaign management capabilities tend to be more comparable across insurers. Larger P/C insurers are more likely to have mature API capabilities for marketing partners than their smaller counterparts. The opposite is true for smaller life insurers, perhaps reflecting a greater willingness among smaller life insurers to customize for key marketing and distribution partners.

The N100 framework is also available as a self-rating tool for insurers; if you’re a Novarica client or Research Council member interested in benchmarking your company, feel free to contact [email protected] to receive a copy.

Add new comment