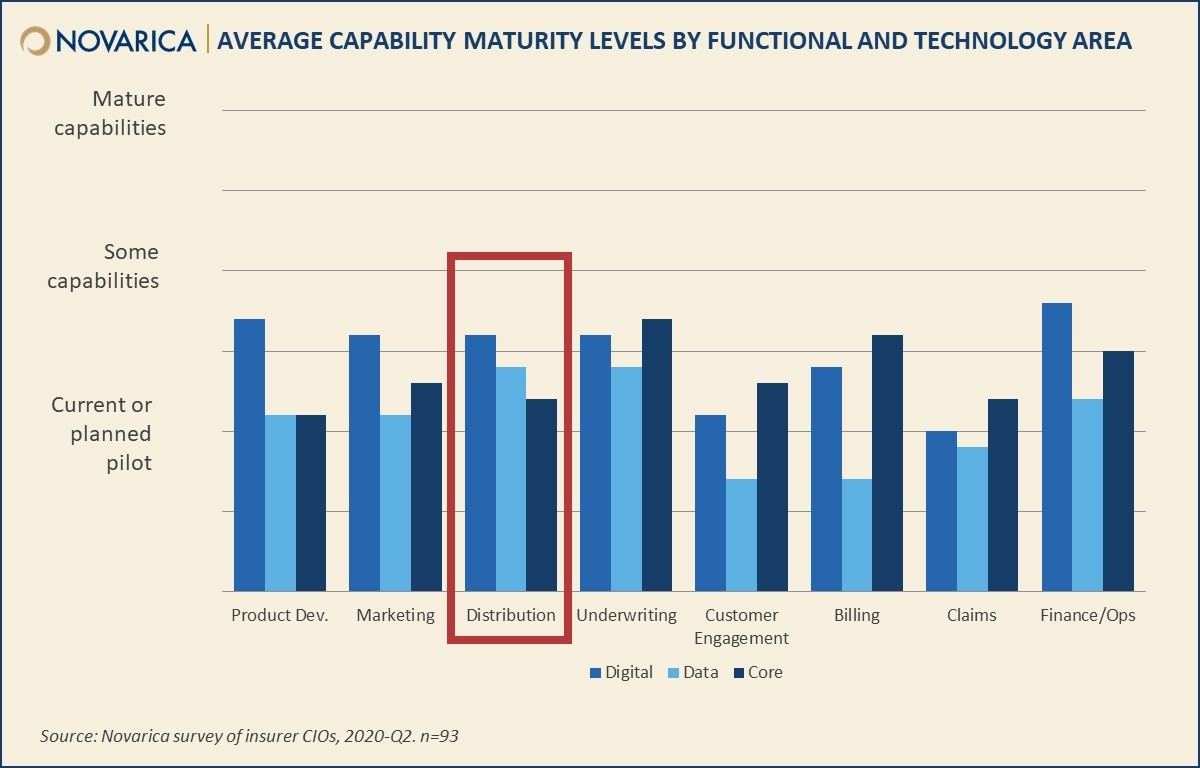

Distribution capabilities at insurers increasingly reflect the integrated nature of modern insurance sales. Novarica’s 2020 N100 benchmarking study indicates that digital distribution capabilities have improved over the past several years and that data capabilities to pre-fill application information and speed up the sales process are becoming table stakes. But for other areas, especially core technologies, insurers are still developing capabilities.

The Novarica 100 Framework includes 12 capabilities in each of eight functional areas: product development, marketing, distribution, underwriting, customer engagement, billing, claims, and finance/operations. These capabilities are divided evenly into four digital, four data, and four core functions. There are also four capabilities specific to IT operations that round out the even 100.

Digital capabilities in distribution include digital access to account data and the ability to execute any transactions digitally.

Data and analytics distribution capabilities include leveraging external data for pre-fill to speed up the application process, reporting capabilities for distribution partners, and analytics to optimize distribution networks.

Distribution core capabilities include self-service licensing and appointments for distribution partners and externalizable APIs for better integration of insurer distribution management systems with partner systems.

Many digital capabilities in distribution are now table stakes. Over half of all insurers have at least some mobile-optimization capabilities, and nearly three-quarters have capabilities for full account access and transactional ability. Midsize life insurers are less developed in this area.

Distribution data capabilities are uneven. The use of pre-fill data and partner network performance reporting is widespread; more than three-quarters of insurers report current capabilities or pilots. However, more advanced analytics, like rules-based offer guidance and partner network optimization, are still emerging at most insurers.

Core distribution capabilities are the least developed at most insurers, but this is also an area where larger insurers tend to have more mature capabilities than their midsize counterparts. The gap is most noteworthy in self-service licensing and externalizable API capabilities, especially among property/casualty insurers. The largest P/C insurers have made substantial investments in integrating with their partner networks.

The N100 framework is also available as a self-rating tool for insurers; if you’re a Novarica client or Research Council member interested in benchmarking your company, feel free to contact [email protected] to receive a copy.

Add new comment