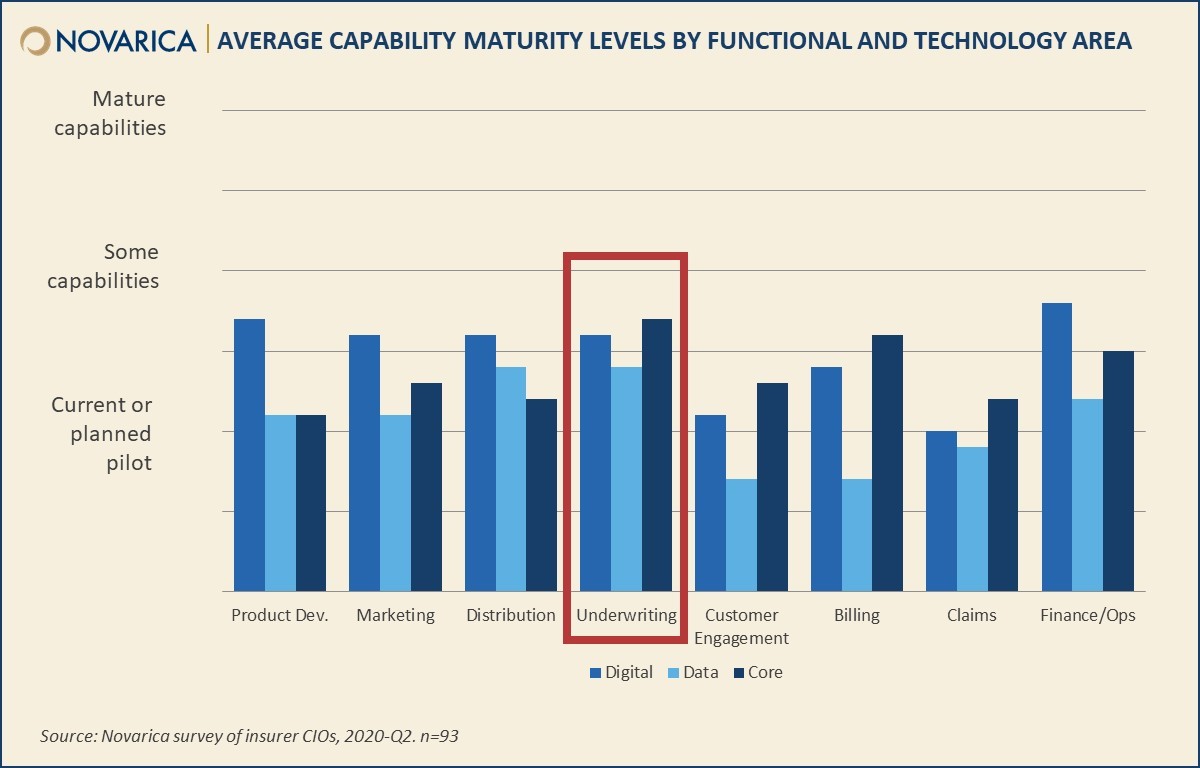

Rating and pricing risk are among the most critical business functions for any insurer, so it makes sense that insurers’ technological capabilities are most mature on average in underwriting. However, this overall maturity can conceal variations in deployment by size and sector. While capabilities like digital workflow and predictive scoring are common everywhere, insurers vary considerably in their experimentation with technologies like machine learning or the maturity of their APIs.

The Novarica 100 Framework includes 12 capabilities in each of eight functional areas: product development, marketing, distribution, underwriting, customer engagement, billing, claims, and finance/operations. These capabilities are divided evenly into four digital, four data, and four core functions. There are also four additional capabilities specific to the operations of IT to round out the even 100.

Digital capabilities in underwriting include single sign-on and digital workflow capabilities as well as tools for collaboration both internally and externally.

Data and analytics underwriting capabilities cover integrating data sources as well as using predictive modeling and machine learning/AI to model risks and book of business impact.

Underwriting core capabilities include straight-through processing, skills-based routing, and quick-quote capabilities. This area also covers externalizable APIs to integrate underwriting systems with partner systems.

Digital workflows and single sign-on capabilities are approaching table stakes in insurance, with more than 75% of carriers having some capabilities in this area. Internal collaboration tools are fairly common among large property/casualty insurers, but less so among other sectors.

Underwriting data capabilities vary by insurer size and sector. P/C insurers are more likely to have capabilities for integrated data and analytics than life insurers, and larger insurers are more likely to be experimenting with machine learning and AI than smaller insurers. Predictive scoring is fairly common among all insurers. This is especially noteworthy among life insurers, where fluidless underwriting has become more common since the onset of COVID-19.

Insurers tend to have core underwriting capabilities that are more mature than core capabilities in other functional areas. Externalizable APIs are a major point of distinction among property/casualty insurers; 95% of large insurers have deployed them, compared to only 58% of midsize. Another 25% of midsize insurers are piloting APIs, however, so this gap may narrow in the future.

The N100 framework is also available as a self-rating tool for insurers; if you’re a Novarica client or Research Council member interested in benchmarking your company, feel free to contact [email protected] to receive a copy.

Add new comment