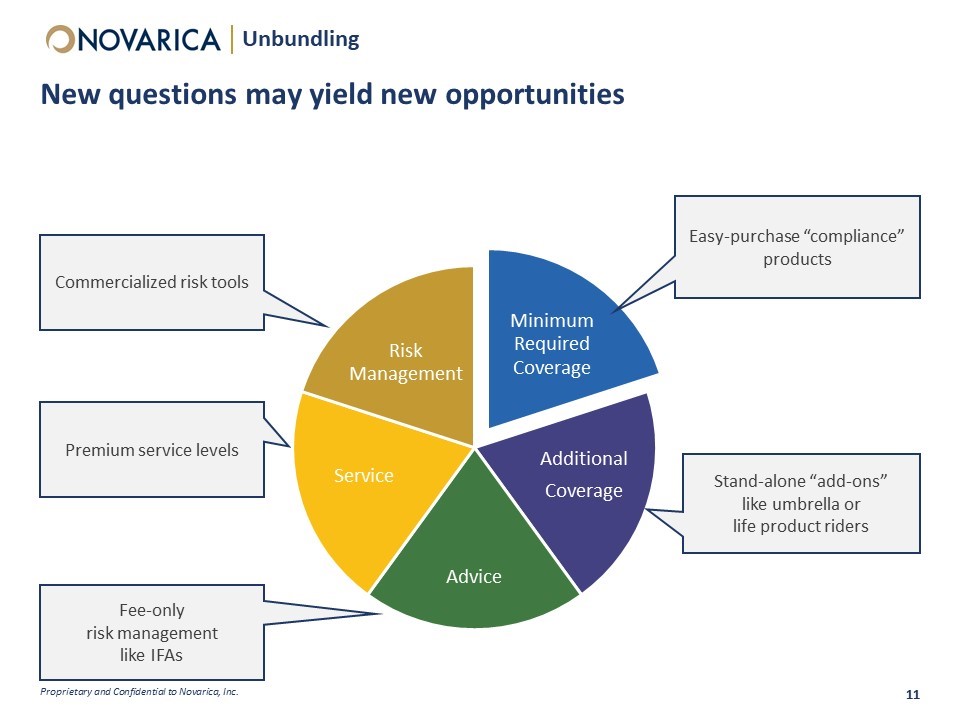

This week MassMutual announced that it was commercializing some of its risk analysis capabilities through a partnership between its LifeScore Labs division and iPipeline. As Novarica noted last year, the evolution of new technology capabilities will give insurers the opportunity to commercialize some of the risk and servicing capabilities they’ve developed. Until now, insurers have only monetized these capabilities by selling loss reimbursement. Initiatives like this, and Allstate’s recent moves to spin off its telematics division as Arity and its program to sell roadside assistance to non-policyholders through a partnership with Waze, are showing that insurers are starting to diversify ways to monetize both their risk and service capabilities.

This week MassMutual announced that it was commercializing some of its risk analysis capabilities through a partnership between its LifeScore Labs division and iPipeline. As Novarica noted last year, the evolution of new technology capabilities will give insurers the opportunity to commercialize some of the risk and servicing capabilities they’ve developed. Until now, insurers have only monetized these capabilities by selling loss reimbursement. Initiatives like this, and Allstate’s recent moves to spin off its telematics division as Arity and its program to sell roadside assistance to non-policyholders through a partnership with Waze, are showing that insurers are starting to diversify ways to monetize both their risk and service capabilities.

While loss reimbursement is a critical and necessary product, insurers have the potential to improve the lives of their customers in many other ways, from helping them avoid loss in the first place to helping them find trusted service providers outside the context of an emergency. This is only the beginning of a broadening of the industry’s value proposition.

While this may seem like a sideshow for now, it’s worth remembering that Amazon Web Services (AWS) began as a way to monetize capacities that were built to support other services. Perhaps the insurance industry is on the cusp of its own AWS moment?

Add new comment