Novarica recently published its Novarica New Normal 100 reports, which covers 100 digital, data, and core capabilities for P/C and L/A insurers. The capabilities addressed fall into eight functional areas: product development, marketing, distribution, underwriting, customer engagement, billing, claims, and finance/operations.

Underwriting includes gathering risk data, analyzing it, and communicating with distributors and/or buyers during the process. Digital underwriting capabilities focus on the internal workflow and collaboration environment, while straight-through processing, quick quoting, and routing capabilities are considered related to core systems within the framework. Integrating data sources and using predictive modeling and machine learning/AI are data and analytics capabilities.

Digital underwriting capabilities and increased underwriting efficiency and accuracy were of particular interest to insurers this year. Amerisure, for example, built a cloud-based underwriter workstation to leverage rules-based questioning. Replacing the old underwriting process with AI is improving profitability, consistency, and efficiency: onboarding underwriters now only takes 90 days instead of 12 months, the efficiency of documenting underwriting files increased by 50%, and the average underwriting audit score increased from 79% to 87%.

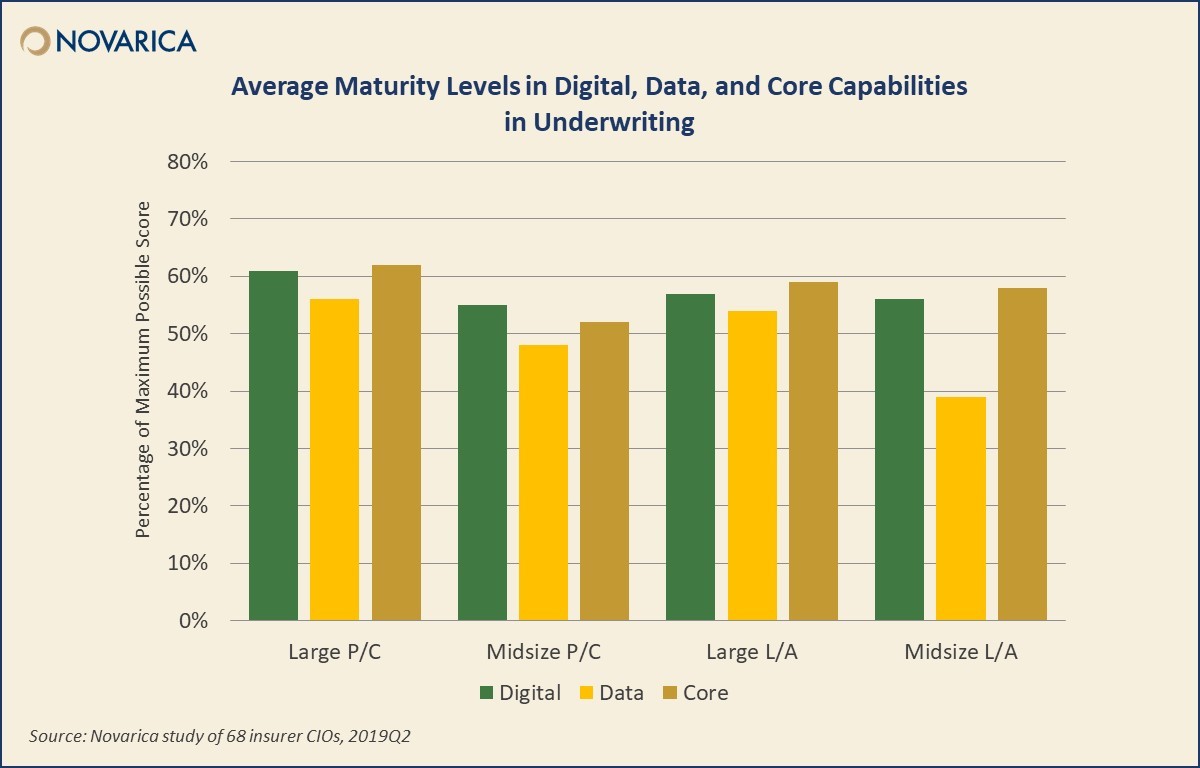

On the P/C side, the gaps have narrowed somewhat in digital underwriting capabilities since 2018, as more smaller insurers report at least some capabilities in all areas. Even the analytics gap in underwriting is narrowing, though larger insurers are more actively deploying and piloting machine learning. Larger insurers still have more mature straight-through processing capabilities, but a strong group of midsize insurers (about a third) are piloting new technologies.

For the L/A group, underwriting maturity levels have increased in several key areas, including digital workflow and internal collaboration, the use of predictive scoring, and straight-through processing. Larger insurers are more mature in analytics but have comparable capabilities to midsize insurers in almost all other areas.

For more on digital, data, and core capability benchmarks, checkout the Novarica New Normal 100: Digital, Data, and Core Capabilities for P/C Insurers and the Novarica New Normal 100: Digital, Data, and Core Capabilities for L/A Insurers. For more case studies, see our Insurance Technology Case Studies Compendium 2019.

Add new comment