Novarica recently published its Novarica New Normal 100 (3N100) reports for L/A and P/C insurers, and this week I’ve been recapping the reports’ major findings across the eight functional areas they survey. Each report benchmarks insurers across 100 digital, data, and core capabilities that span all areas of the insurance value chain, including product development, marketing, distribution, underwriting, customer engagement, billing, claims, and finance/operations.

Digital claims capabilities are focused on streamlining communications from claimants to adjusters and third-party providers, and include capturing information from IoT devices. Claims data and analytics capabilities primarily focus on building and applying predictive models, while core capabilities cover straight-through processing, skills-based routing, and customer communication management.

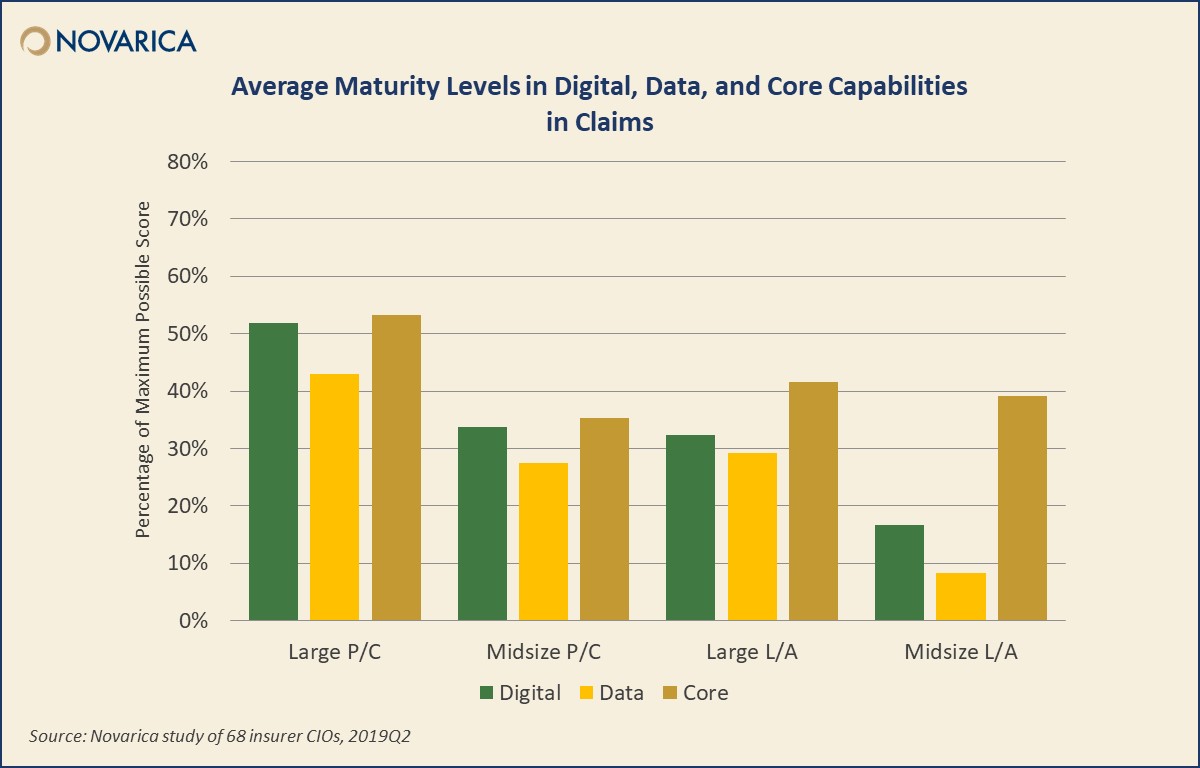

For all but large P/C insurers, claims capabilities tend to be one of the least mature areas within an organization, especially for digital and data. In one sense, that’s not surprising, as claims has often been viewed as a cost center. But claims is also the “moment of truth” when insurers justify their value to their customers, and those consumers’ expectations are increasingly shaped by online banking and shopping experiences.

Large P/C insurers have felt this pressure to improve, and eventually those expectations will come to midsize insurers and life/annuity carriers. Claims naturally tends to be a larger concern for P/C insurers, and midsize P/C carries are showing a lot of pilot activity to match the digital experiences of their larger peers. But life carriers also showed an uptick in investment in fully digital experiences this year.

As one example, Bankers implemented an instant messaging and chatbot platform to offer customers better claims communication and self-service inspection scheduling. The technology cut the average time to contact policyholders and conduct inspections by 50% during hurricane season, and increased claims closed within 30 days by a factor of 15. Bankers won a 2019 Impact Award for the project.

For data capabilities, predictive analytics are becoming table stakes for larger P/C insurers, and smaller P/C carriers and large life carriers are also showing interest. Even midsize L/A carriers have substantial pilot activity for claims fraud scoring. Machine learning and AI applications are not yet common, but there is a great deal of pilot activity among P/C carriers.

Sometimes data capabilities can be as simple as getting more and better data more quickly to the people who need it. In 2018 Allstate won an Impact Award for a drone imaging program, implemented with vendor partner EagleView, which incorporated analytical reports and still imagery collected via drones into Allstate’s claims process. The effort reduced cycle times by 30-40% and improved overall adjuster efficiency by 50-60%.

Claims core capabilities tend to be more reliable, since insurers who can’t pay claims don’t stay in business for very long. Skills-based routing is fairly common, and straight-through processing and omnichannel CCM are becoming so. Integration and consolidation can be success factors here; in 2017 Pennsylvania and Indian Lumbermen’s Mutual reported achieving 50% reduction in time-to-issue claims payments by consolidating two core claims systems and two imaging platforms into a single system.

For more on the claims digital experience see Deb Zawisza’s recent report on Digital Claims Payments, and for more on this year’s 3N100 for Claims, see the 3N100 for P/C Insurers and the 3N100 for L/A Insurers.

Add new comment