We recently published the Novarica New Normal 100, for P/C and L/A, which covers 100 digital, data, and core capabilities for insurers across eight functional areas: product development, marketing, distribution, underwriting, customer engagement, billing, claims, and finance and operations.

Billing is an opportunity for insurers to directly interact with customers, and errors in this sphere can have significant effects. In turn, most carriers are investing in digital billing capabilities. Digital billing capabilities are all related to electronic communications and payments using current channels and payment mechanisms, but do not include emerging payment mechanism like Bitcoin. Outdated billing systems can cause insurers to miss out on both new revenue opportunities and meeting their customers’ expectations.

Many carriers seek efficiency gains as well as service advantages when enhancing their billing capabilities. For example, we published a case study a little while ago about Unum’s mobile-enabled plan administrator portal that supports online payments for its Colonial Life division. The project led to a 67% increase in online payments as well as a projected $1.4M in efficiency savings over five years. Customers reported positive feedback, citing the ease of making payment.

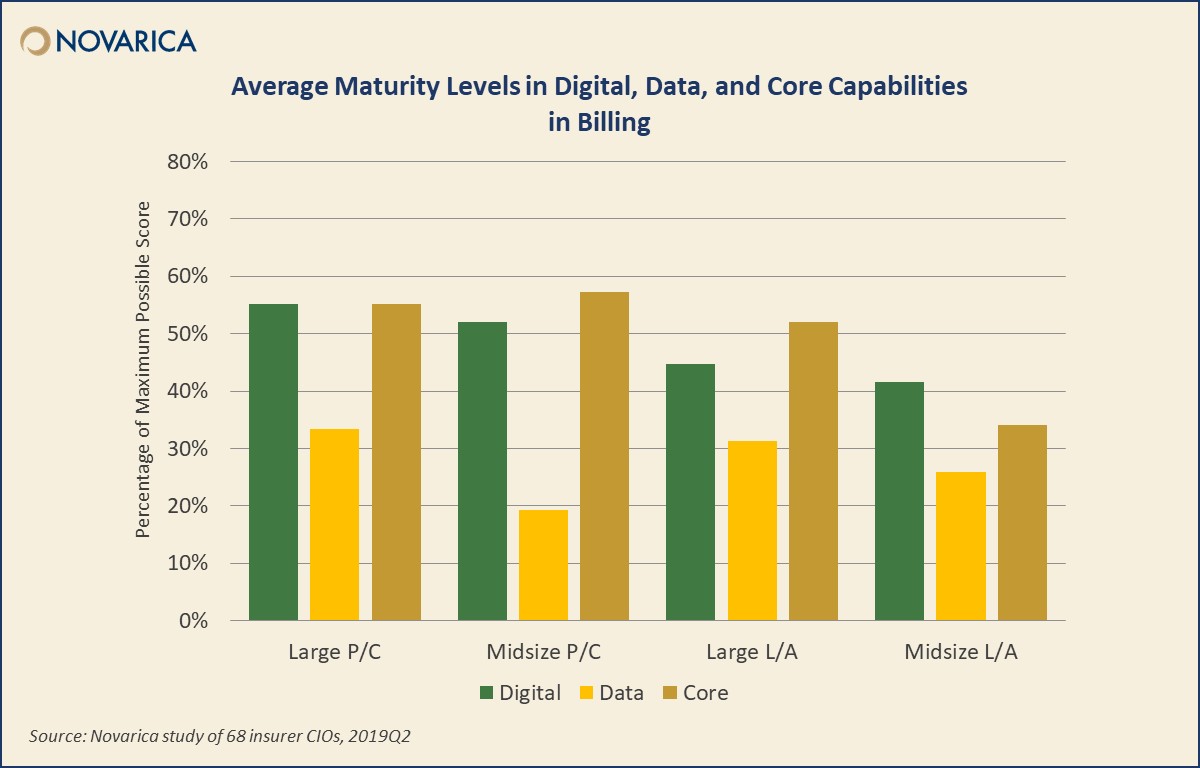

For small and midsize P/C carriers, there is comparatively low maturity level for billing data and analytics, but higher at larger insurers. Life carriers are focusing on enhancing their data analytics capabilities for billing on strengthening internal performance analytics as well as expanding analytics to drive customer messaging.

For more on this year’s New Normal for Billing, see Novarica New Normal 100: Digital, Data, and Core Capabilities for Property/Casualty Insurers and Novarica New Normal 100: Digital, Data, and Core Capabilities for Life/Annuity Insurers. For more case studies, see our Insurance Technology Case Studies Compendium 2019.

Add new comment