In an age when old systems are being updated and new technologies are streamlining everyday processes, one of the key areas of transformation in the insurance industry is billing. Outdated billing systems can cause insurers to miss out on both new revenue opportunities and meeting their customers’ expectations. Forthcoming development includes improving digital capabilities (such as adding new payment methods), increasing numbers of cloud deployments and SaaS pricing models, improving the ability to communicate real-time billing information via Web, mobile, text and virtual assistants, and improving support for new usage based offerings, micro-products and flexible billing plans.

The perception of billing is changing along with its technical capabilities—most insurers now view billing as a customer service issue instead of solely a financial one. Billing is an opportunity for insurers to directly interact with customers, and errors in this sphere can have significant effects. Errors can lead to lower retention rates, costly reinstatements to repair accidental cancellations, an increase in call volume, or other unnecessary manual efforts. By modernizing their billing platform, insurers can address increasing customer expectations while experiencing increased operational efficiency, improved cash management, and better available data.

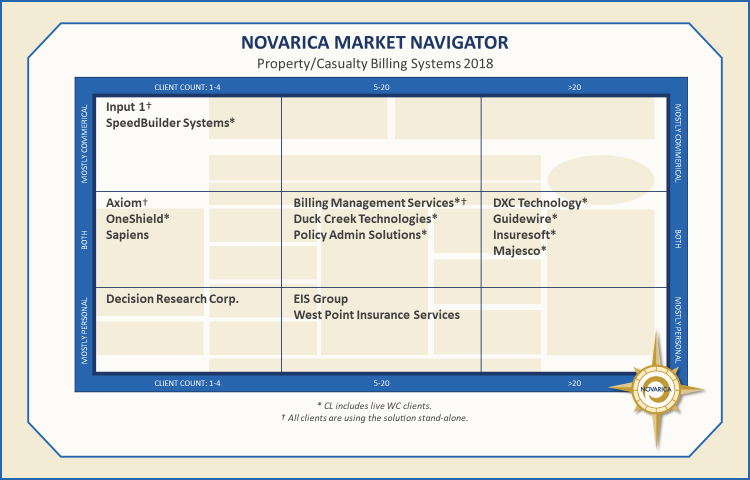

Novarica’s newest Market Navigator profiles the 15 major solutions in the Property/Casualty billing space. There were no major new entrants to the market this year, but there has been movement in the installed base, line of business experience, deployment options and functionality offered. The market is made up of a handful of vendors that have proven scale and market momentum with larger and midsize insurers, and others that have done well with smaller insurers or start up endeavors.

The vendor market for billing solutions is active this year, mostly because the policy administration market is active. While all of the solutions profiled in this report can be run as stand-alone billing solutions, most insurance billing vendors offer billing and policy solutions that are pre-integrated either at the application level through Web services or at the database level. Many vendors have rearchitected their billing offerings to modernize their technology, normalize their technical approach with other product offerings, and/or enhance the configuration of their solutions, and even more are now offering their billing solutions in a variety of deployment models: hosted, SaaS, and on-premise.

For more on the state of billing in the insurance market and an overview of solution providers in this space, see Novarica’s latest Market Navigator, Property/Casualty Billing Systems.

Add new comment