For personal auto insurers, the story of the last few years can be summed up in just a few words: rising claims costs.

The confluence of riskier driving, costlier auto components, supply chain disruption, and inflationary pressures created a 2022 that was the worst in many carriers’ histories, with a number of auto insurers posting combined ratios above 100, including some high-profile industry leaders with ten- and eleven-figure losses.

Rising claims costs have knock-on effects across the insurance organization. For one thing, they make it difficult to rate policies (it’s tough to price when you can’t accurately project loss costs). Reinsurance costs are also going up, and on the regulatory side, many carriers can only raise premiums so much to offset this increase.

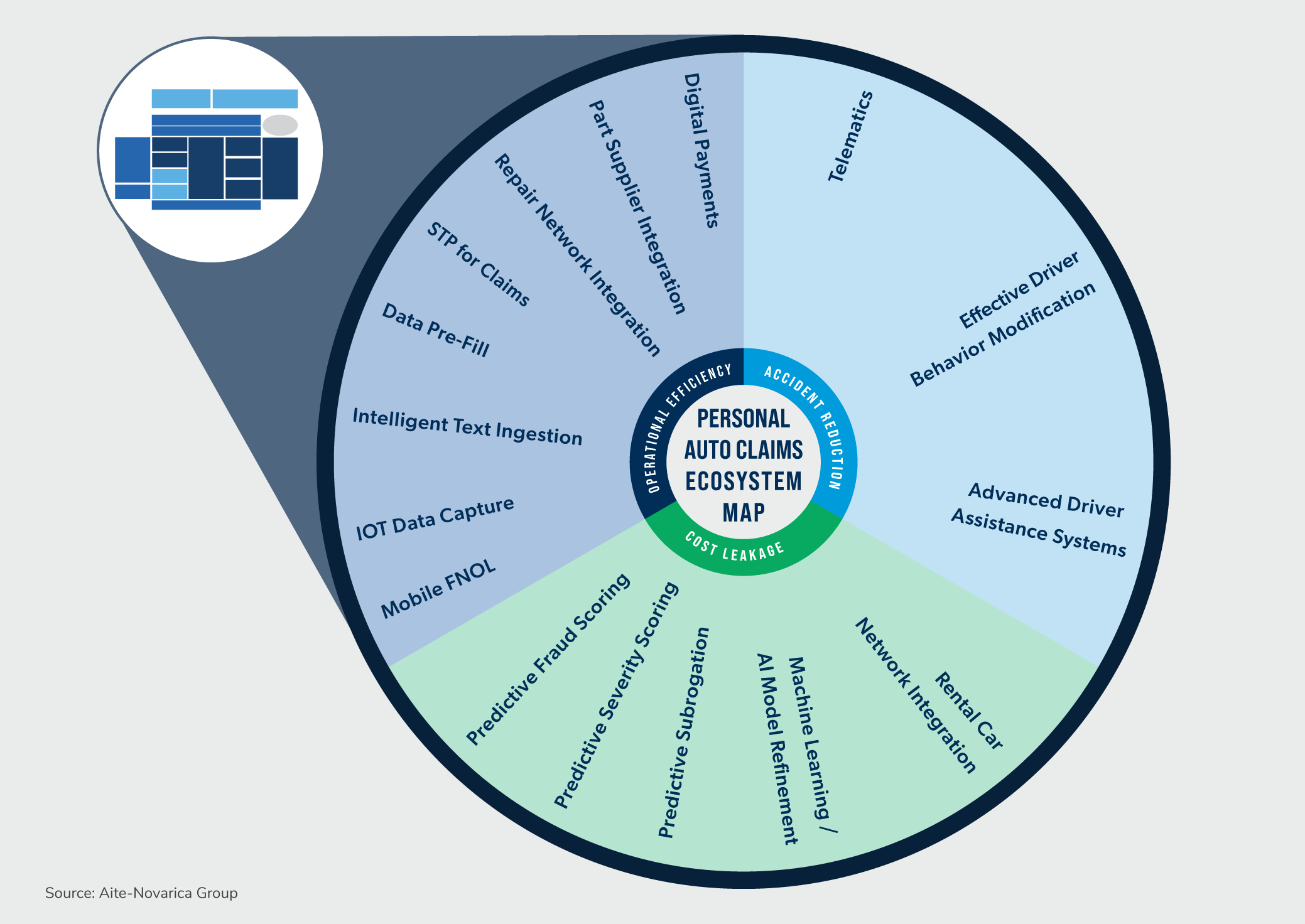

Claims losses are the largest single cost center within an insurer, so they’ve always been targets for cost savings, and insurers have a range of technological options for addressing rising claims costs. Broadly speaking, these include solutions that create savings through operational efficiency, cost leakage control, and accident reduction.

Mitigating Rising Claims Costs

For several years, insurers have invested in digital and data capabilities to improve operating efficiency and control cost leakage. But one of the key takeaways of 2022 is that claims costs are challenging even when an accident is well understood and adjusted quickly. Because insurers can’t control factors like component shortages, shipping delays, and rental car availability, claims costs are never fully in their control nor fully predictable.

For that reason, carriers may want to give additional attention to accident-reduction technologies like advanced driver assistance systems (ADAS) features, telematics, and driver behavior modification solutions.

ADAS features are generally out of an insurer’s control, although some players are looking to quantify their effect on overall safety to more accurately rate policies (for example, Swiss Re).

Telematics is an area gaining ground among insurers looking to better understand their risk profiles. It’s extremely useful for identifying when drivers make unsafe maneuvers; by discouraging these behaviors (such as by lowering a driver score or discount), insurers can motivate drivers to be safer.

Improving Driver Behavior

When it comes to actually helping drivers build better driving behavior, there’s effective driver behavior modification, which helps drivers practice safer habits like hazard detection, risk perception, and speed and space management. The latter go beyond watch-and-forget driver training videos by offering interactive modules that test skill development and offer immediate feedback, a critical element for learning.

These don’t have to be either-or propositions. In fact, these solutions can combine effectively to supplement one another’s strengths: Telematics can be used to identify dangerous driving actions, for example, and then driver behavior modification modules can be used to help drivers build safer habits. To complete the cycle, insurers can then use telematics to monitor how the driver’s skills have improved and whether more training is needed.

Using Technology for Accident Prevention and Claims Cost Reduction in Personal Auto, a newly published white paper commissioned by ADEPT Driver and produced by Aite-Novarica Group, examines these accident reduction solutions in the context of rising claims costs. Read the full white paper here to learn more.

Add new comment