What Banks Want From Supply Chain Finance

Report Summary

What Banks Want From Supply Chain Finance

Banks are very careful about which SCF applications they select when developing the infrastructure of an SCF platform.

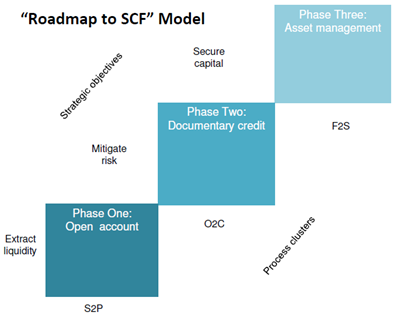

London, 11 April 2012 – A new report from Aite Group discusses what banks want from a supply chain finance (SCF) software platform and details the terminology, infrastructure, and models of supply chain finance. The report is based on the results of an online Q1 2012 Aite Group survey of 48 representatives of bank interests in SCF software applications. It introduces Aite Group’s “Roadmap to SCF” reference model, which illustrates Aite Group’s perspective on the phased evolution of an SCF software platform.

As supply chain finance continues to become more mainstream, banks are becoming increasingly well informed about the topic. That doesn’t mean that the terminology around supply chain finance is always consistent, however; a big gap remains between what different parties mean by the term. As a result, banks often lack an understanding around what functionalities constitute an SCF software platform. Because of this confusion, banks that are developing the infrastructure of an SCF platform keep a wide spectrum of options open regarding the applications they want to include and are very careful about which SCF applications they select.

“Before deciding which software applications to include in their SCF platform, banks must recognize and understand which supply chain operations processes are important and strategic to the corporate client segment that the bank aims to service,” says Enrico Camerinelli, senior analyst with Aite Group and author of this report.

This 42-page Impact Report contains 15 figures and six tables. Clients of Aite Group’s Wholesale Banking service can download the report.