U.S. Retirement Income: The Shift from Accumulation to Decumulation

Report Summary

U.S. Retirement Income: The Shift from Accumulation to Decumulation

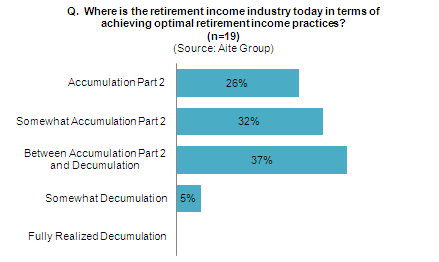

Boston, November 22, 2011 – A new report from Aite Group assesses the state of the U.S. retirement income marketplace, which includes retail-distribution financial advisors, asset managers, insurance firms, online brokerages, and banks. Based on a July to September 2011 Aite Group survey of 22 senior financial services executives who serve this marketplace, the report considers the industry’s progress and the issues it faces in moving from wealth accumulation to decumulation.

The retirement income industry in the United States is still in its infancy, with the shift from accumulation to decumulation evolving slowly. Investment outcomes and lessons from 2008 continue to weigh heavily on investors’ minds, and many consumers were unable to do the one thing necessary to enjoy a comfortable retirement: save adequately. As a result, retirement income firms across various silos—banks, broker-dealers, independent advisors, registered investment advisors (RIAs), insurance firms, asset managers, defined-contribution record-keepers, etc.—are grappling with the question of how to construct appropriate and suitable retirement income plans for clients across various wealth bands.

“The shift from wealth accumulation to decumulation is where financial advisors and distribution firms must transform their practice-management skills,” says Greg Cherry, senior analyst with Aite Group and author of this report. “The accumulation practices of the past are simply not sustainable as consumers demand less market risk and an increased focus on one day replacing their paychecks with retirement paychecks.”

This 33-page Impact Report contains 15 figures. Clients of Aite Group’s Wealth Management service can download the report.