Retirement Income and Investor Types: Pre-Retiree and Retiree Differences

Report Summary

Retirement Income and Investor Types: Pre-Retiree and Retiree Differences

Boston, September 25, 2012 – A new report from Aite Group provides a snapshot of the upper half of retired and pre-retired U.S. investors—broken out by pre-retirees who are more than 10 years away from retirement, pre-retirees who are less than 10 years away from retirement, and current retirees—and further segments them by generation. Based on an online December 2011 Aite Group survey of 1,014 U.S. investors who hold a minimum of US$25,000 in investable assets and have access to online trading, this report will aid firms in addressing each group’s needs.

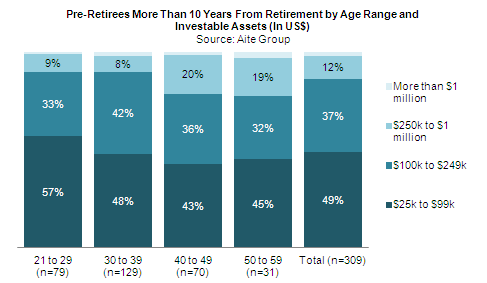

Despite representing the upper half of households in terms of overall wealth, the three groups discussed in this report are investable-assets-challenged. Among pre-retirees, 86% of pre-retirees more than 10 years from retirement and 74% of those less than 10 years from retirement have less than US$250,000 invested outside of an employer-sponsored plan; among current retirees, this number falls to two-thirds. Because US$250,000 has become the asset marker for large brokerage firms, lower-asset households go untargeted by such financial advisors, and other firms benefit from lower-asset investors’ business.

“Pre-retirees and retirees ignored by advisor firms tend to use retail banks and online services for their post-retirement financial needs,” says Greg Cherry, senior analyst with Aite Group and author of this report. “Even among investors with more than US$250,000 in investable assets, the majority are self-directed in terms of their investing style. Advisory firms interested in courting this segment would do well to leverage online investor services that speak to this strong self-directed tendency.”

This 51-page Impact Report contains 33 figures and two tables. Clients of Aite Group’s Wealth Management service can download the report.