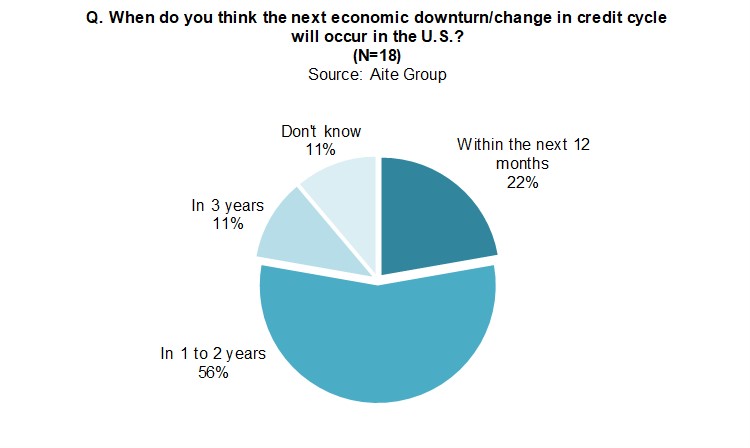

Boston, December 10, 2019 – After a devastating recession in 2008, consumer lenders have enjoyed an extended period of growth, especially lenders making personal loans. These lenders are now anticipating a change in the credit cycle and taking steps to become prepared for such an eventuality, whether it occurs in the next six months or several years from now.

Drawing from the findings of a recent survey of U.S. consumer lenders conducted by Aite Group and sponsored by Equifax, this report provides insights on what lenders with large, unsecured personal loan portfolios are doing to ensure they are ready for the next economic downturn, when they expect it to occur, and how it might impact their business. It is based on an Aite Group telephone survey of 18 leading U.S. consumer lenders conducted in May and June 2019.

This 20-page Impact Report contains 11 figures and one table. Clients of Aite Group’s Retail Banking & Payments service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Equifax, Experian, FICO, ID Analytics, and TransUnion.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.