Boston, November 17, 2021 – Real-time payments have become an essential part of the fabric of the payments industry globally. In the U.S., adoption really began to take off after the launch of The Clearing House’s RTP network in November 2017. Checking in on this four years later, much progress has been made to enable the majority of business accounts in the U.S. to at least be able to receive a real-time payment.

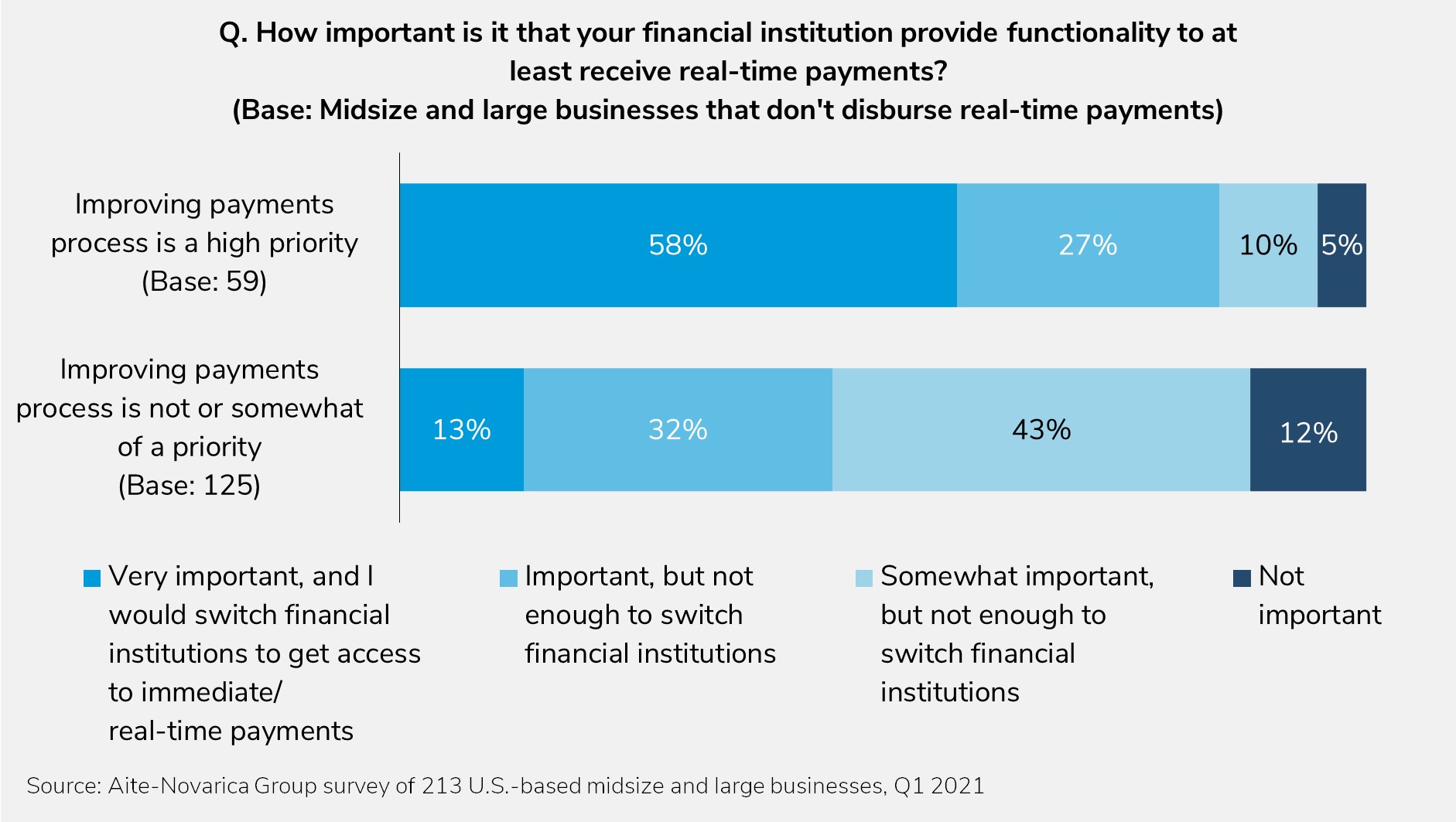

This report details the first RTP transaction and looks at the most predominant use cases, use cases to come, and, most importantly, the opportunity cost of not offering businesses access to real-time payments. It is based on three Aite-Novarica studies: a quantitative survey of 117 U.S. community banks and credit unions from Q2 2020; a Q1 2021 quantitative survey of 251 payment decision-makers at small, midsize, and large enterprises in the U.S.; and a February 2021 quantitative survey of 213 U.S.-based midsize and large businesses.

This 27-page Impact Report contains seven figures and three tables. Clients of Aite-Novarica Group’s Commercial Banking & Payments service can download this report.

This report mentions BNY Mellon, U.S. Bank, and Volante.

About the Author

Erika Baumann

Erika Baumann serves as Director of the Commercial Banking & Payments practice at Datos Insights, focusing on payables and receivables technology and solutions. She has over 10 years of experience in the wholesale banking space, bringing expertise from both banking and fintech vendor positions. She has worked extensively with both U.S. and international banks, vendors, and the clients of each to identify...