MiFID II, Asset Manager Edition: The Final Countdown

Report Summary

MiFID II, Asset Manager Edition: The Final Countdown

Buy-side firms will likely face challenges as MiFID II and MiFIR come into force, and preparedness levels vary.

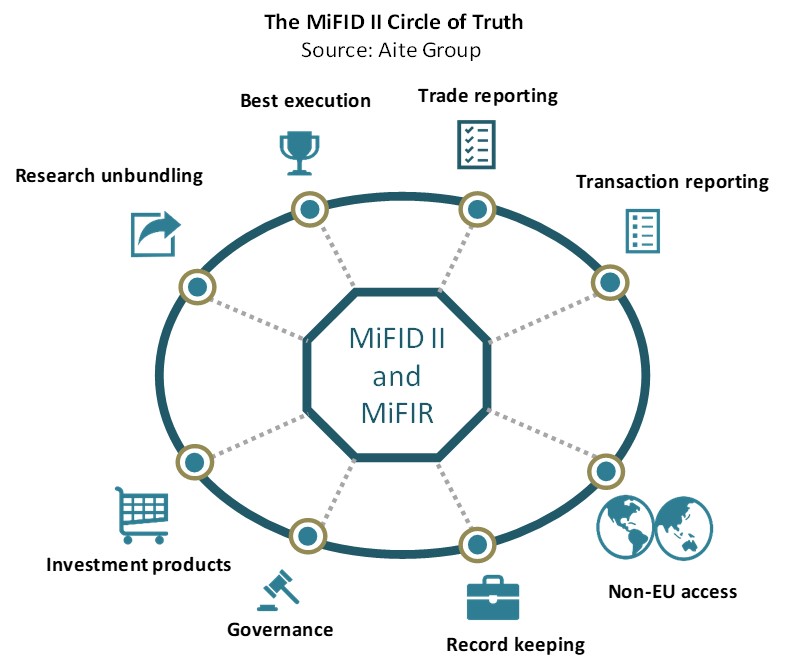

London, 14 December 2017 – On January 3, 2018, the asset management community in Europe and other firms with European operations will likely hold their collective breath with anxiety as the revised Markets in Financial Instruments Directive II and Markets in Financial Instruments Regulation come into force. What key requirements will impact buy-side firms, and what are some of the practical and operational challenges that buy-side firms are likely to face due to these requirements?

This Impact Note makes recommendations for buy-side firms on preparations, from technology implementation to the use of third-party reporting services. It is based on Aite Group interviews conducted with buy-side market participants, including those from traditional asset managers and hedge funds. Interviews were conducted between August 2017 and October 2017.

This 48-page Impact Note contains 12 figures and eight tables. Clients of Aite Group’s Institutional Securities & Investments service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Abide Financial, AIM Italia, BATS, Bloomberg, Brevan Howard, CBOE, Eurex Exchange, Euroclear, Getco Europe, Goldman Sachs Group, Investec Asset Management, Janus Henderson, JPMorgan, Liquidnet, London Stock Exchange, MTS Italia, Nasdaq, Tradeweb Europe, Trax, Tudor, and Xtrakter.