February 17, 2022 – For many of today’s insurance departments, success is measured by customer satisfaction and employee productivity; inefficient processes and incomplete or inconsistent information create friction that can hold carriers back. The industry is turning to new technology solutions that automate and streamline everyday tasks to complement and enhance the productivity of skilled knowledge workers and customer service representatives. Intelligent decisioning is the ability for artificial intelligence (AI) to ingest each piece of data and make a decision, or determine the next best action.

This Impact Report, sponsored by Shift Technology, explains what intelligent decisioning is and covers different use cases of AI and its applicability in automating processes across the insurance life cycle. This report is based on Aite-Novarica Group’s domain expertise and knowledge base, along with secondary research and briefings with industry executives.

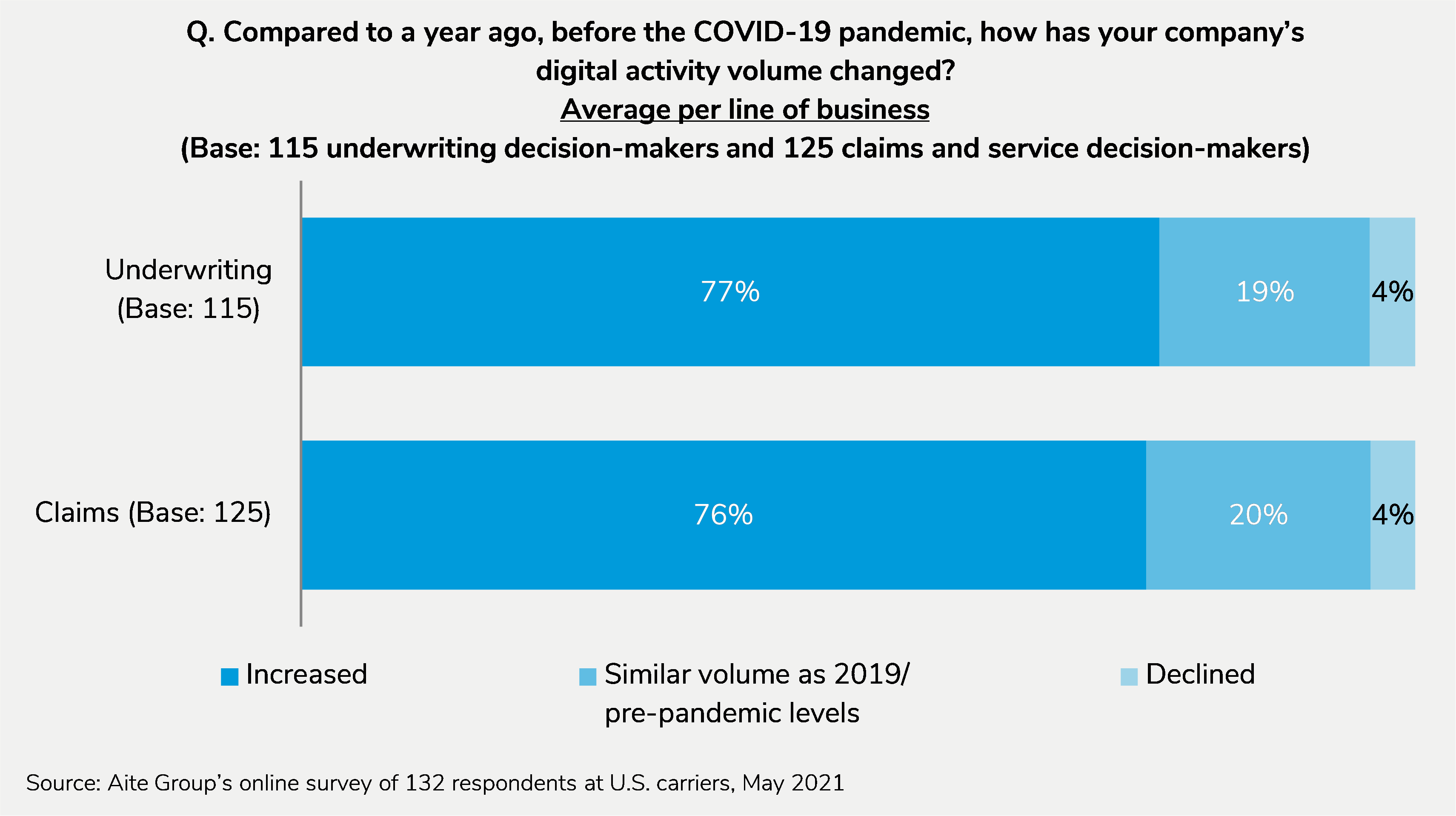

This 16-page Impact Report contains two figures and one table. Clients of Aite-Novarica Group’s Property & Casualty service can download this report and the corresponding charts.

About the Author

Martin Higgins

Martin Higgins is a Senior Principal at Datos Insights. He has over two decades of experience working in insurance technology, having served as Practice Director for Edgewater Consulting, where he was responsible for the company’s property and casualty business nationwide. He has expertise in technology strategy, core system selection and implementation, Agile transformation and DevOps, business intelligence, systems integration, legacy...