July 5, 2022 – As the commercial payments landscape continues to evolve, technology is becoming more accessible, and small businesses have new opportunities to adopt tools associated with the procure-to-pay process. Real-time payments play a large role in this landscape, providing small businesses the benefit of instant and frictionless payments to improve working capital, recipient satisfaction, and operational workflows.

This report identifies the advantages of RTP capabilities for small businesses that financial institutions and vendor partners should be aware of and know how to position. It is based on Aite-Novarica Group research from two 2021 surveys of U.S.-based small businesses and on interviews with representatives from The Clearing House.

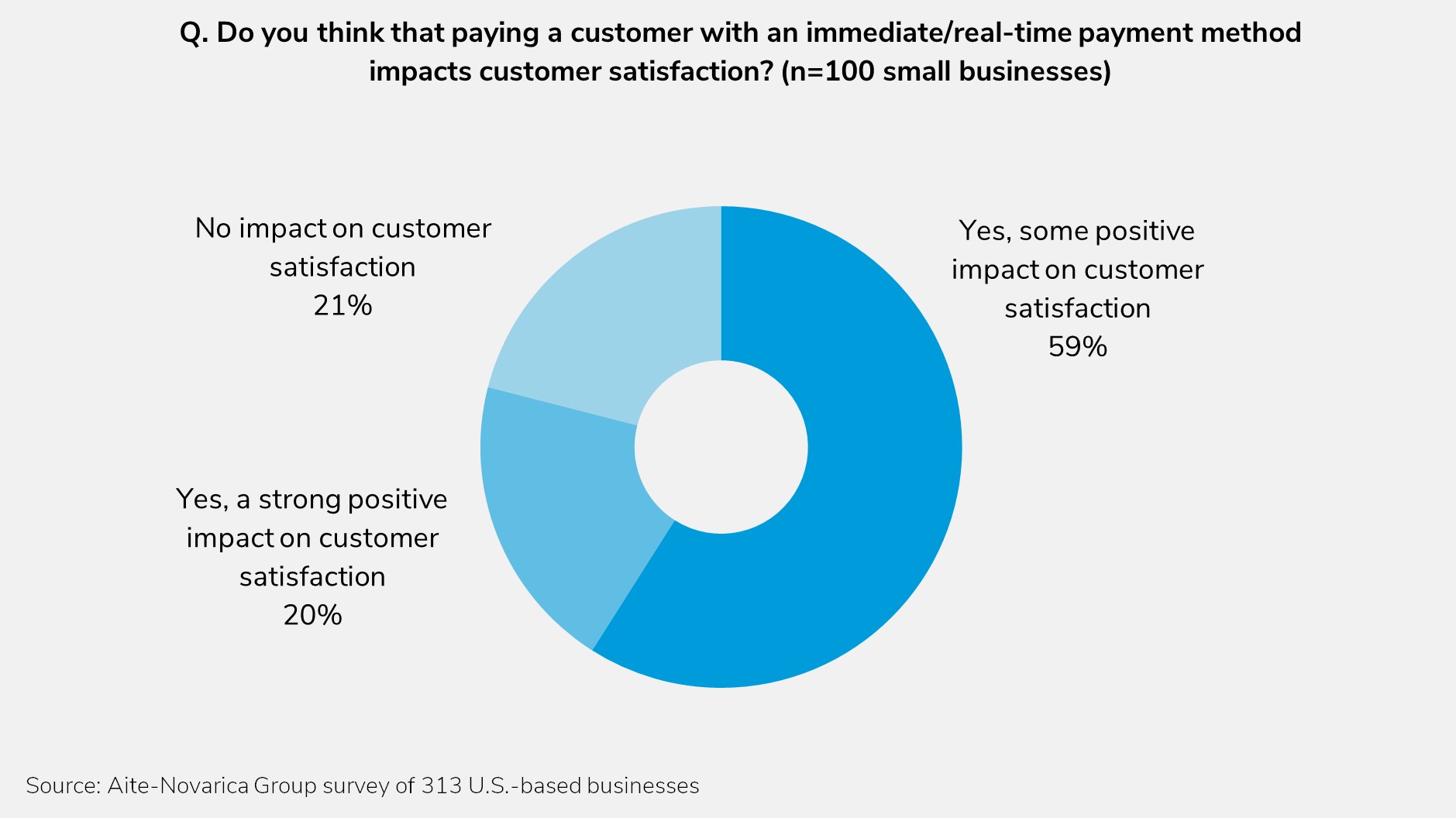

This 13-page Impact Report contains three figures. Clients of Aite-Novarica Group’s Commercial Banking & Payments service can download this report and the corresponding charts.

This report mentions BNY Mellon, The Clearing House, and U.S. Bank.

About the Author

Erika Baumann

Erika Baumann serves as Director of the Commercial Banking & Payments practice at Datos Insights, focusing on payables and receivables technology and solutions. She has over 10 years of experience in the wholesale banking space, bringing expertise from both banking and fintech vendor positions. She has worked extensively with both U.S. and international banks, vendors, and the clients of each to identify...