Guideposts for Building a DLT Roadmap: Think Inside the Capital Markets Box

Report Summary

Guideposts for Building a DLT Roadmap: Think Inside the Capital Markets Box

Capital markets firms must be aware of regulatory and operational limitations when building out DLT business cases.

Boston, September 7, 2017 – Industry participants’ attitudes toward distributed ledger technology remain a dichotomy—some tout the promise of blockchain, and some doubt its necessity. But those who would ignore this technology risk missing something truly transformational for the long-term in the settlement environment and other areas. In this context, business leaders must determine a suitable business case for DLT application in capital markets as well as plan and execute a DLT adoption strategy that maximizes the technology’s transformational value.

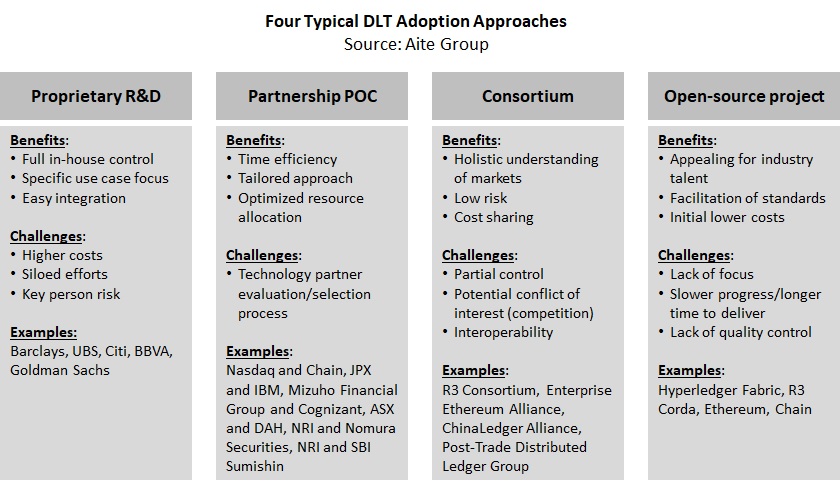

The second in a series (find the first here), this report provides a strategic roadmap to adopting DLT, with deep considerations of the technology’s operational suitability and the adoption challenges inherent to capital markets. It is based on qualitative Aite Group interviews conducted from February to June 2017 with over 15 executives heading up blockchain innovation at capital markets firms and fintech vendors.

This 27-page Impact Report contains five figures and two tables. Clients of Aite Group’s Institutional Securities & Investments service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Accenture, Amazon Web Services, Axioni, Chain, Clearmatics, Deloitte, Digital Asset Holdings, Equichain, Ernst & Young, IBM, Infosys, Juzix, KPMG, Microsoft, Paxos, PWC, Ripple Labs, R3, Setl, Symbiont, Synechron, and Wipro.