The Growing Popularity of Commodity- and Currency-Based ETFs: In for the Long Haul?

Report Summary

The Growing Popularity of Commodity- and Currency-Based ETFs: In for the Long Haul?

Commodity- and currency-based ETFs are growing in popularity despite challenges unique to these types of ETFs.

Boston, December 9, 2011 – A new report from Aite Group examines the growth of commodity- and currency-based exchange-traded funds (ETFs), associated challenges, and potential for further growth.

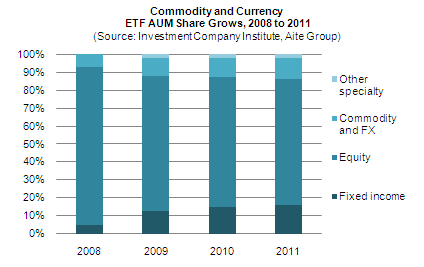

Until fairly recently, commodity- and currency-based ETFs were a scarce breed on the fund landscape. The number of new issuances of commodity-based ETFs and currency-based ETFs has grown manyfold since 2004 and 2006, respectively. In terms of assets under management (AUM), commodity-based ETFs grew from slightly more than US$1 billion in 2004 to US$118 billion at the end of October 2011; currency-based ETFs, which began with less than US$1 billion in 2006, have reached just north of US$8 billion. Challenges exist that could impact growth rates, however, including high fluctuations in commodity prices and currency exchange rates.

“Despite such a rapid growth rate, the market for commodity- and currency-based ETFs is just getting started,” says Howard Tai, senior analyst with Aite Group and author of this report. “These products’ cost-effectiveness, strategic asset allocation, and tactical investor appeals are all very compelling, especially considering that equity market returns have been dismal over the past 10 years, and that consistently low interest rates globally have made it risky to shift investor dollars solely to fixed income ETFs or fixed income mutual funds.”

This 33-page Impact Note contains eight figures and three tables. Clients of Aite Group’s Institutional Securities & Investments can download the report.