January 10, 2023 – Automation and value-added payment capabilities are removing manual intervention, allowing for instant settlement and generating opportunities for market differentiation among businesses and banks. Meanwhile, business end users have greater choice in payment providers and significantly higher expectations and demands for robust, real-time payment capabilities than ever before. Banks and other FIs are challenged with meeting the needs of an increasingly sophisticated client base while providing best-in-class cash management and payment solutions to their customers.

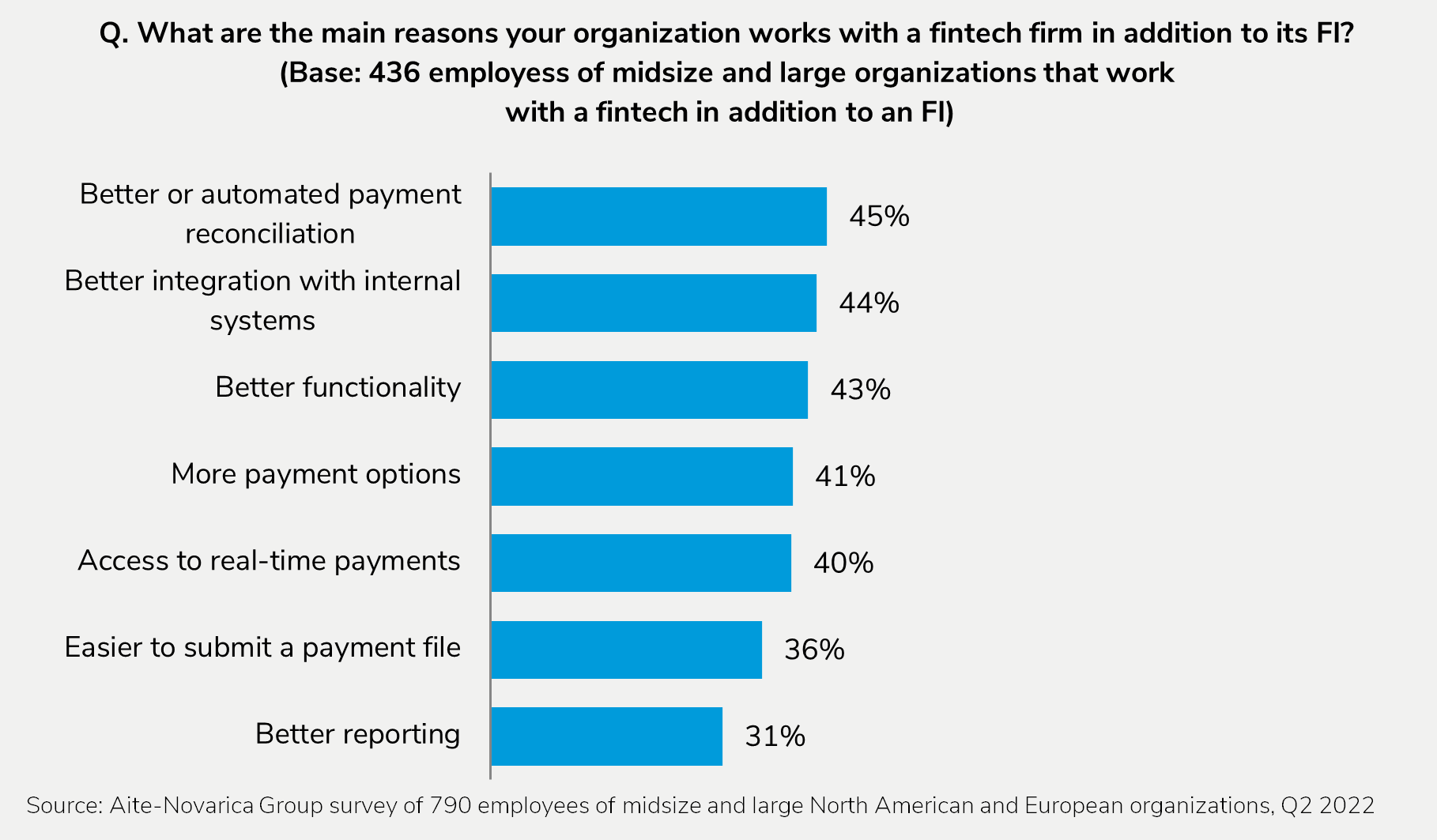

This report identifies supporting trends in the future of payments and discusses potential synergies between banks and fintechs as they collaborate on new ways to drive growth. It is based on an online survey of 790 employees of midsize and large corporate entities in seven North American and European countries (Canada, France, Germany, Italy, Spain, the U.K., and the U.S.) that Aite-Novarica Group undertook in Q2 2022.

Clients of Aite-Novarica Group’s Commercial Banking & Payments service can download this report and the corresponding charts.

About the Author

Erika Baumann

Erika Baumann serves as Director of the Commercial Banking & Payments practice at Datos Insights, focusing on payables and receivables technology and solutions. She has over 10 years of experience in the wholesale banking space, bringing expertise from both banking and fintech vendor positions. She has worked extensively with both U.S. and international banks, vendors, and the clients of each to identify...