Boston, October 9, 2019 –Employment levels in the U.S. may be high, but real earnings are not. The truth is that incomes have remained stagnant for nearly half a century. The costs of retirement, health, and college have soared in the same time span, creating a deepening gap between the two. This creates a financial impasse and becomes a major source of stress for many employees. Employers have been increasingly leaning on an assortment of benefits that lend themselves to improving employees’ financial well-being to bridge that gap.

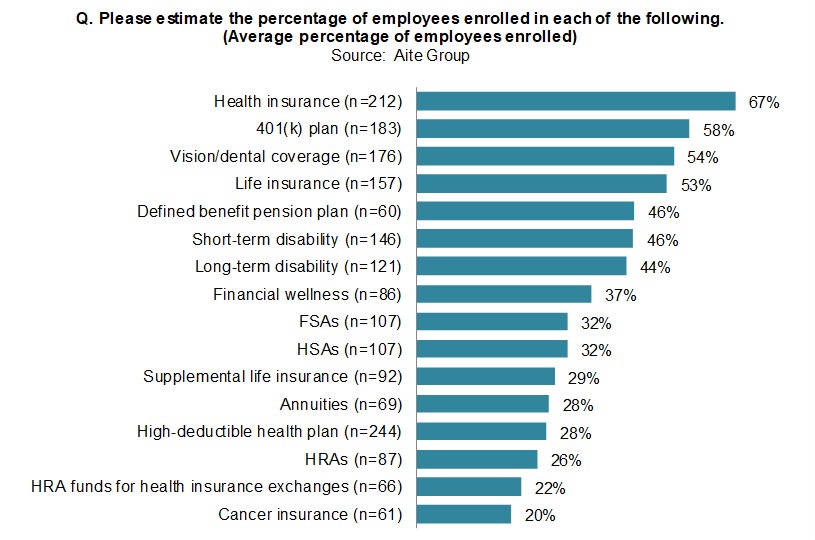

This research captures views from a cross section of employer benefit decision-makers across employer sizes, and it identifies the trusted sources they turn to for obtaining advice, support, administration, and training for financial wellness services. It is based on a Q2 2019 quantitative survey of 303 human resource professionals and employer benefit decision-makers in the U.S. across a range of employer sizes.

This 38-page Impact Report contains 28 figures and one table. Clients of Aite Group’s Wealth Management, Health Insurance, or Life Insurance service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions ADP, Aetna, Allstate, Ameriprise, AON, Assurance IQ, Bank of America Merrill Lynch, Blue Cross Blue Shield, Cigna, JPMorgan Chase, Empower, Envestnet Yodlee, Fidelity, Financial Finesse, Frenkel Benefits, Guardian, The Hartford, Humana, John Hancock, Kaiser, Mercer, MetLife, Picwell, Prudential, Raymond James, Schwab, State Farm, TIAA, Towers Watson, Transamerica, USAA, Vanguard, Wells Fargo, and WellStar.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.