Boston, October 8, 2019 – Despite U.S. financial institutions establishing controls, policies, and procedures, and using various fraud prevention systems, losses inevitably occur. Fortunately, FIs employ fraud investigators, who are responsible for attempting to retrieve funds that have left the FI fraudulently. If law enforcement officials work with the investigator, can fraudsters be prosecuted and sentenced to prison?

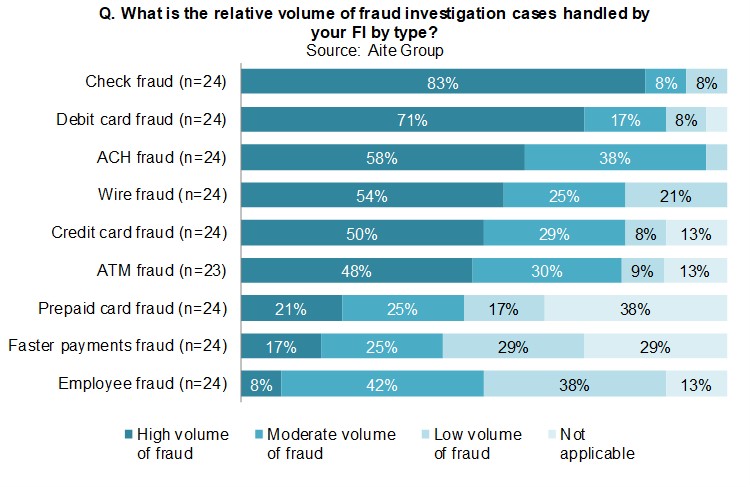

This Impact Report focuses on the primary types of fraud cases investigators deal with day to day as well as some of the challenges they face in their role. It is based on surveys completed by 26 U.S.-based FI fraud investigators attending TIAA’s 2019 Fraud Summit on May 1, 2019.

This 21-page Impact Report contains 14 figures and two tables. Clients of Aite Group’s Fraud & AML service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Customer XPS, FIS, Fiserv, IBM, Nice Actimize, SAS, and Verafin.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.