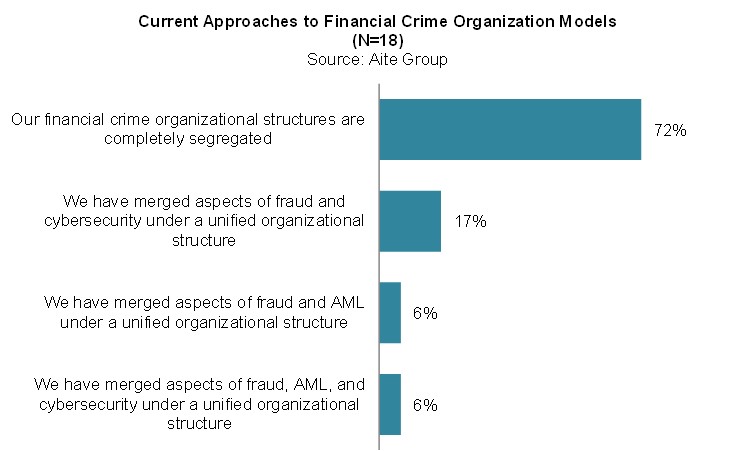

Boston, April 20, 2021 – Silos within financial crime functions are the criminal’s best friend. Malicious actors have exploited, and continue to exploit, the walls that separate fraud, anti-money laundering, and cybersecurity units at financial institutions. Appreciating this Achilles’ heel, FIs have tried aligning these functions closer together, but achieving convergence is hard. It necessitates an organizational commitment; a substantial investment of time, money, and resources; and frequently a culture change. But with finite resources, FIs see increased financial crime convergence as a key weapon against a common enemy.

This report explores the evolving financial crime risk landscape, the growing importance of greater financial crime collaboration and alignment, and the various approaches currently being taken by FIs. It is largely informed by Aite Group interviews with 18 executives from a representative sample of FIs across the U.S. and Canada. The research is supplemented by insights from surveys of financial crime practitioners who attended Aite Group’s 2019 and 2020 Financial Crime Forums.

This 29-page Impact Report contains 11 figures and two tables. Clients of Aite Group’s Fraud & AML service can download this report, the corresponding charts, and the Executive Impact Deck.

About the Author

Chuck Subrt

Charles (Chuck) Subrt is the Director of Datos Insights' Fraud & AML practice, and he covers anti-money laundering and compliance issues. Chuck brings 20 years of legal and compliance experience and a deep expertise advising business leaders, driving change, and establishing strong, self-sustaining AML and financial crime compliance and risk management programs at a global financial services company. For the past 10 years, Chuck led multiple compliance functions for Sun...