FATCA: An Initial-Impact Assessment

Report Summary

FATCA: An Initial-Impact Assessment

London, 24 October 2012 – A new report from Aite Group provides an overview of the current U.S. Foreign Account Tax Compliance Act (FATCA) provisions of the Hiring Incentives to Restore Employment (HIRE) legislation. It assesses the implementation of these provisions by non-U.S. financial institutions that must comply with this extraterritorial U.S. legislation starting in 2013.

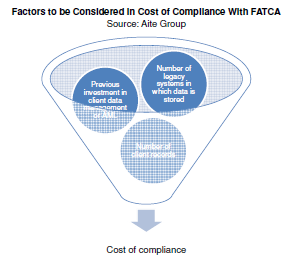

With trillion-dollar annual budget deficits in the United States and a federal debt approaching 100% of gross domestic product, a U.S. tax gap amounting to hundreds of billions of dollars each year cannot go ignored. In March 2010, the U.S. HIRE Act, which contains the FATCA provisions, was signed into law to force non-U.S. financial institutions to disclose to the U.S. government information about clients subject to U.S. taxation. It appears that the implementation of this legislation will be achieved via various bilateral, intergovernmental agreements rather than through a single law applicable to all financial institutions worldwide. While compliance will undoubtedly be costly and onerous, Aite Group expects that the real costs for individual firms will vary based on the state of the client account data in question and the technology and systems framework that stores that data.

“The first priority for any FATCA compliance project team should be scoping the size of the data-related endeavor, followed by determining what technology and systems are currently in place to identify and aggregate U.S. indicia data,” says Virginie O’Shea, analyst with Aite Group and co-author of this report.

“Those with a more robust legal entity or client data management framework, anti-money laundering, or Know Your Customer assessment scheme in place are likely to be better positioned to tackle the challenge,” adds Chris Thrappas, senior analyst with Aite Group and co-author of this report.

Vendors named in this report that provide FATCA solutions are Alacra, Appway, Asset Control, AutoRek, Bloomberg, CounterpartyLink, CSC, Credit Dimensions, Datactics, Detica, Dion Global, DST Global Solutions, Fenergo, First Derivatives, GlobeTax, Goal Group, GoldenSource, GoldTier, IBM, Icon Solutions, Informatica, Information Mosaic, Infosys, Interactive Data, Joss Technology, Kingland Systems, Linedata, Markit, Navigant, Nice Actimize, Oracle, Pega, SunGard, Thomson Reuters, Trillium Software, and Wipro Technologies.

This 26-page Impact Note contains five figures and two tables. Clients of Aite Group’s Institutional Securities & Investments, Wealth Management, or Wholesale Banking services can download the report.