January 26, 2023 – As AML compliance costs rise, AML executives continue to seek and invest in tools and capabilities that will improve AML operational efficiency and effectiveness. Though generally satisfied with their current technology stacks, these AML leaders recognize that smarter AML systems can sharpen financial crimes risk detection and drive better decision-making and outcomes. This is becoming increasingly vital as the business, regulatory, and risk landscapes change.

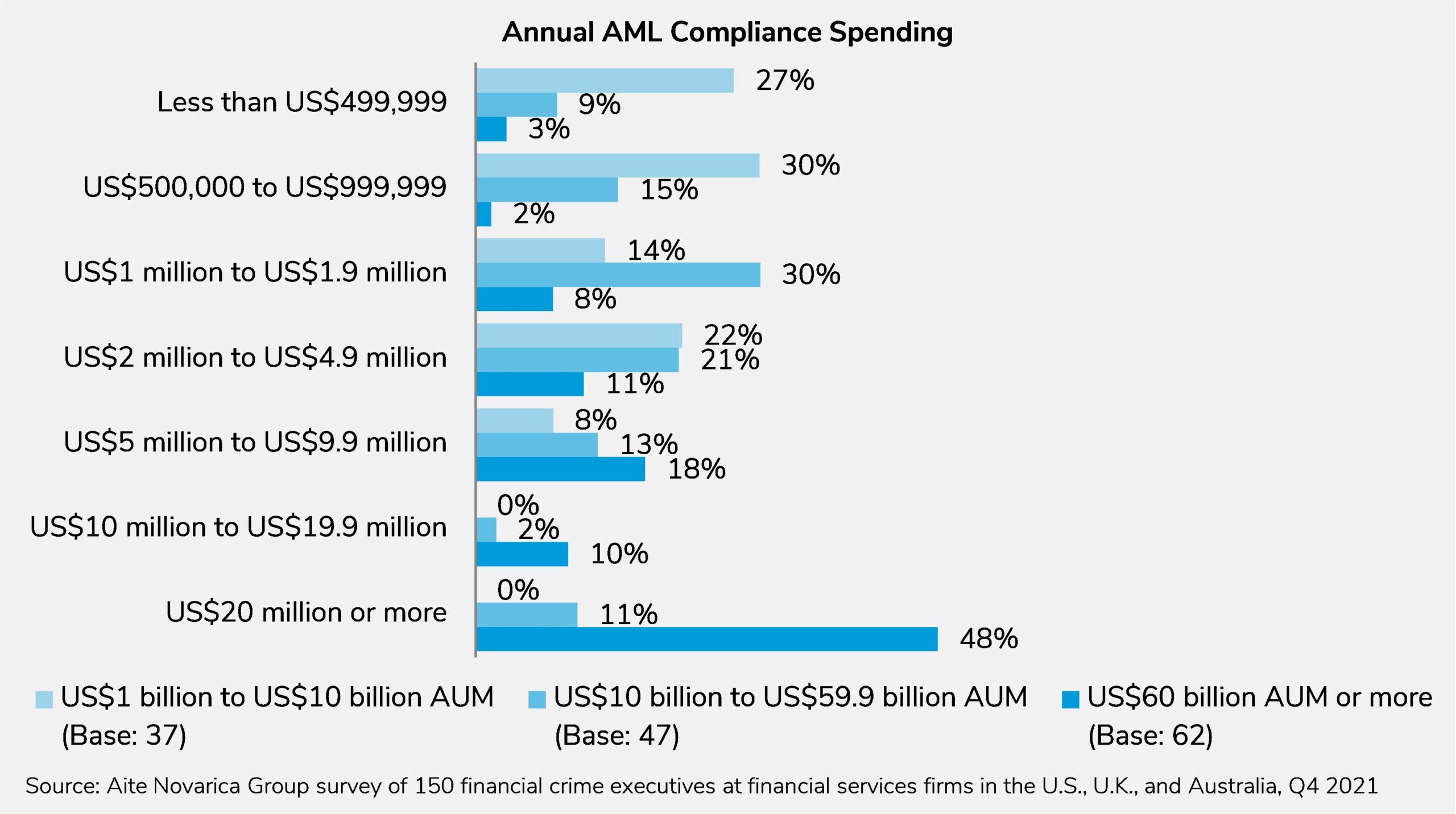

This Impact Report examines the spending habits and diverse approaches of midsize and smaller financial services organizations on AML compliance technology, particularly how they contemplate future investments in innovation. Aite-Novarica Group surveyed 150 financial crime executives across midsize and smaller financial services firms across the U.S., the U.K., and Australia during Q4 2021. Interviews with 15 financial crime executives across similar firms, desk research, and ongoing Aite-Novarica Group research supplemented the analysis for this report.

Clients of Aite-Novarica Group’s Fraud & AML service can download this report and the corresponding charts.

About the Author

Chuck Subrt

Charles (Chuck) Subrt is the Director of Datos Insights' Fraud & AML practice, and he covers anti-money laundering and compliance issues. Chuck brings 20 years of legal and compliance experience and a deep expertise advising business leaders, driving change, and establishing strong, self-sustaining AML and financial crime compliance and risk management programs at a global financial services company. For the past 10 years, Chuck led multiple compliance functions for Sun...