Corporate Mobile Banking: A Look at J.P. Morgan ACCESS Mobile

Report Summary

Corporate Mobile Banking: A Look at J.P. Morgan ACCESS Mobile

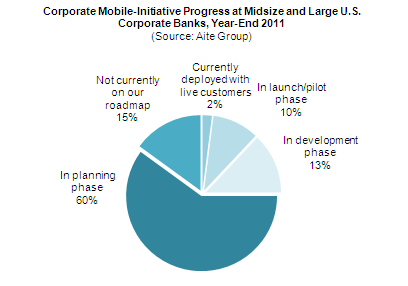

Only a handful of banks around the globe currently offer mobile-banking capabilities to corporate treasurers, but many have plans to do so.

Boston, November 15, 2011 – A new report from Aite Group analyzes the importance of corporate mobile banking as a critical component of any bank’s corporate-banking-technology strategy. The report highlights the current state of corporate mobile technology, and analyzes the key strengths and planned roadmap for J.P. Morgan ACCESS Mobile.

Only a handful of banks around the globe currently offer mobile-banking capabilities to corporate treasurers, but many have plans to do so. Investing in corporate-banking technology is a top priority for chief information officers and technology executives at large banks around the world. These individuals and their institutions understand the importance of middle-market and large-corporate customers, and recognize that more than 60% of corporate treasurers believe their financial institutions do not fully understand corporate-treasurer needs. By increasing focus on the quality and amount of actionable information provided and the ease with which corporate treasurers can access it, financial institutions hope not only to retain these important customers, but also to improve satisfaction levels and cross-sell potential. In July 2011, J.P. Morgan launched ACCESS Mobile, a homegrown corporate mobile application. The J.P. Morgan offering features many of the capabilities that corporations consider mobile-application “must-haves,” and some banks may view it as a model to emulate.

“As the role of the corporate treasurer evolves and becomes more strategic, it is essential that bank products keep pace with customer needs,” says Christine Barry, research director with Aite Group and co-author of this report. “Banks must view corporate mobile banking as more than an extension of the online channel. Mobile banking holds game-changing potential for the financial services industry.”

This 21-page Impact Note contains six figures. Clients of Aite Group’s Wholesale Banking service can download the report.