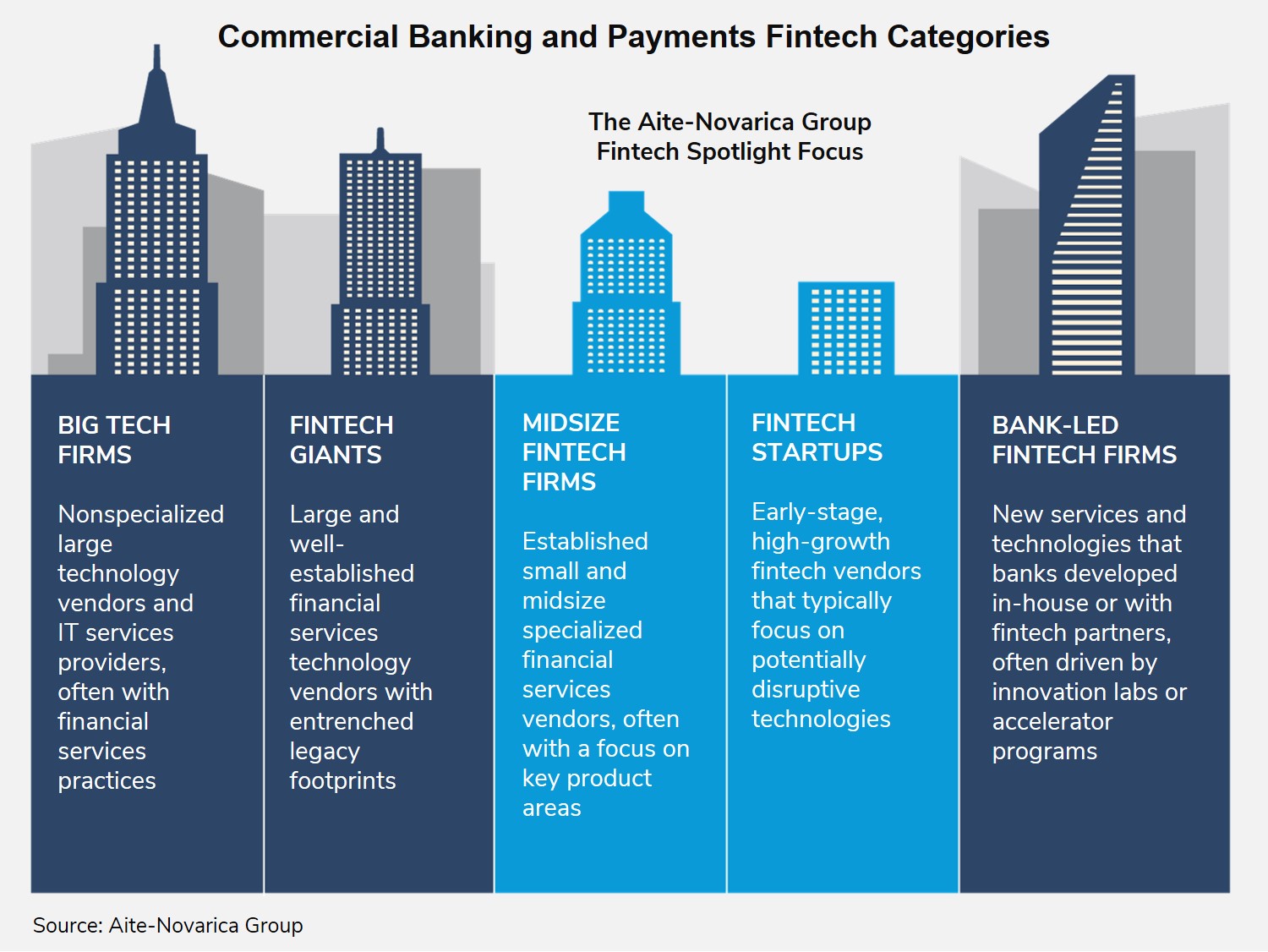

April 5, 2022 –The fintech market is crowded, and it can be difficult for banks, enterprise customers, service providers, and technology vendors to stay up to date with the growing variety of players in this market. Despite the challenges, industry stakeholders at all levels must remain conscious of disruptive players and emerging technology trends.

The Commercial Banking Fintech Spotlight is a quarterly series of reports that looks at selected emerging fintech vendors active in the commercial banking space. This report features six vendors active across various product categories and services that either cater to banks as partners or act as direct competitors to existing bank offers. Featured vendors must be active in payments, receivables, money management, core banking platforms, onboarding, digital banking, data management and analytics, or lending. This Fintech Spotlight includes the following vendors: Built, Caary, Fairplay, Identifee, Mambu, and Raistone.

This 28-page Impact Report contains two figures and six tables. Clients of Aite-Novarica Group’s Commercial Banking & Payments service can download this report and the corresponding charts.

This report mentions ABN Amro, Addition, Amerant Bank, BancoEstado, Brookfield Technology Partners, C2FO, Canapi Ventures, Fin Capital, Goldman Sachs, Grameen America, Index Ventures, League Data, Mastercard, N26, NetSuite, OakNorth, Oracle, Orange Bank, QuickBooks, RPMG, S&P Global, SAP, Seaport Global, Solarisbank, TCV, Third Prime Capital, Wave, Xero, and ZestMoney.

About the Author

Gilles Ubaghs

Gilles Ubaghs is a Strategic Advisor with the Commercial Banking & Payments practice at Datos Insights, where he is focused on business-to-business and commercial payments as well as the role of digital transformation across the enterprise and broader financial services sector. Gilles brings over 15 years of experience in the analysis and financial services space creating a range of syndicated off-the-shelf and...