September 15, 2022 –New crypto-related products and services are emerging alongside traditional products and services. There is a broad range of crypto-assets and other services that FIs will need to support, including smart contracts, settlements, central bank digital currencies, cryptocurrencies, utility tokens, stablecoins, security tokens, non-fungible tokens, and integration with Banking-as-a-Service intermediaries. Banks and FIs will need to update and add to existing architecture blueprints and related roadmaps to avoid redundant infrastructures, applications, and support teams.

This Impact Report presents a checklist of architecture challenges FIs must consider as they move forward with products dependent on distributed ledger technology (DLT) and underlying blockchain technology. This report is based on Aite-Novarica Group research conducted in 2021 and 2022 on blockchain and DLT, in addition to external articles. This report also uses the author’s experience and best practices that Aite-Novarica Group has observed in financial services IT organizations.

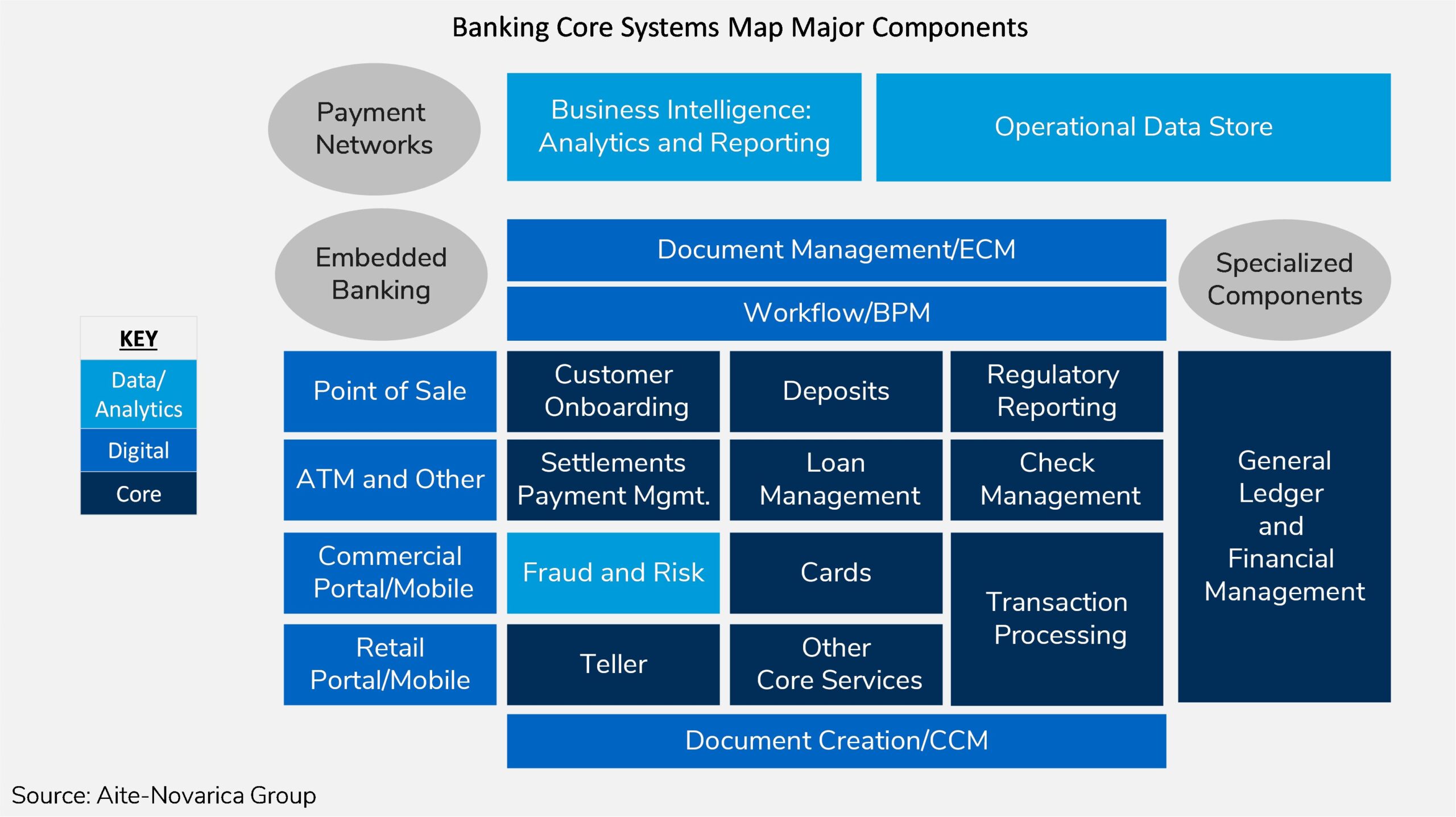

This 24-page Impact Report contains five figures and one table. Clients of Aite-Novarica Group’s Community Banking service can download this report and the corresponding charts.

This report mentions Coinbase.

About the Author

Mitch Wein

Mitch Wein is an Executive Principal in the Insurance Practice at Datos Insights. He has expertise in international IT leadership and transformation as well as technology strategy for banking, insurance (life, annuities, personal, commercial, specialty), and wealth management. Prior to joining Datos Insights, Mitch served in senior technology management positions at numerous financial institutions. At Bankers Trust (now Deutsche Bank), he automated...