Chatbots: Mitigating Rising Costs and Customer Expectations for Insurers

Report Summary

Chatbots: Mitigating Rising Costs and Customer Expectations for Insurers

Chatbots could relieve carriers’ stressed internal resources and deliver better customer experiences.

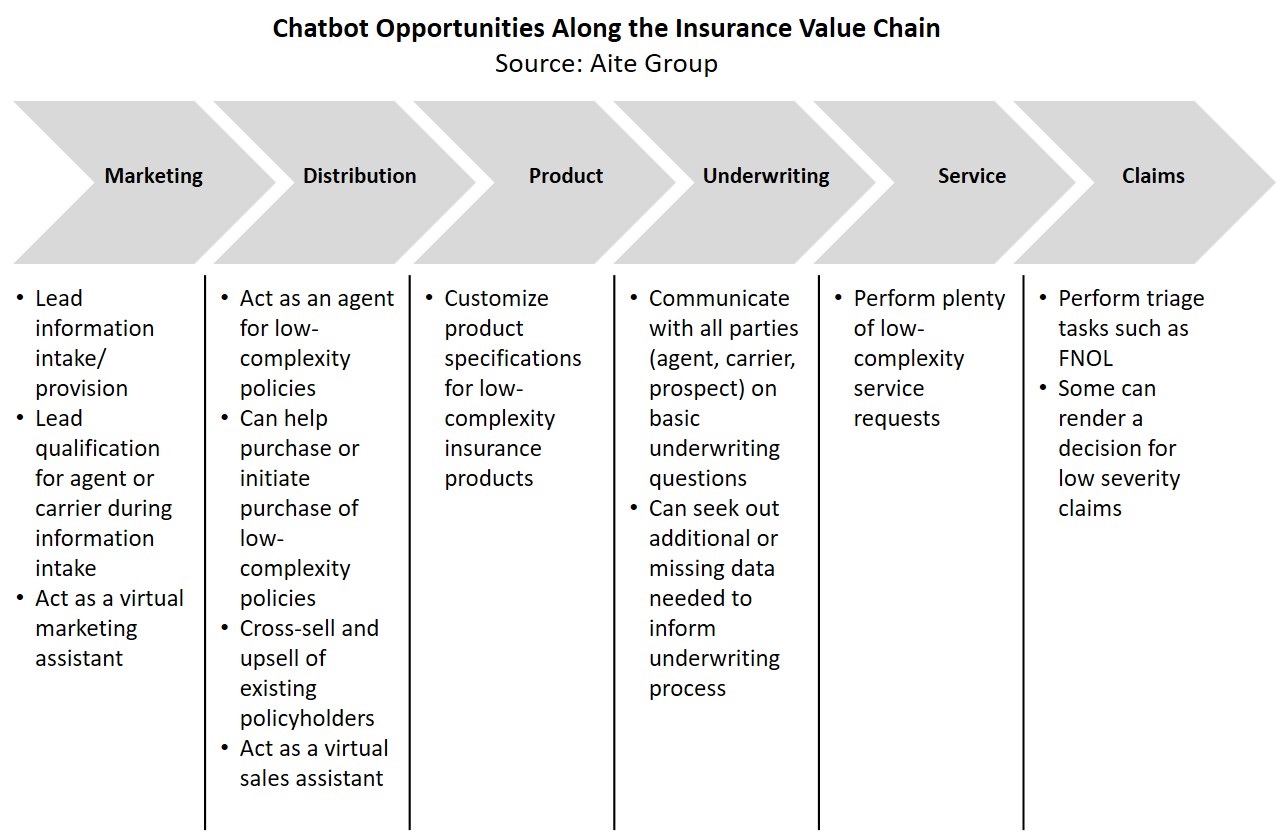

Boston, October 31, 2017 – Property and casualty insurance carriers have been struggling for the past few years with tepid growth in written insurance premiums and the increasing demands of their policyholders. Now, a new challenge has emerged—a nascent shift in how consumers want to interact with their carriers. Could an emerging technology called chatbots alleviate the cost pressures that P&C insurance carriers face while offering prospects and customers better underwriting, distribution, and claims experiences?

This Impact Note shows how chatbots could help insurance carriers mitigate the dual challenges of rising costs and rising consumer expectations and profiles prominent and up-and-coming chatbot providers: Avaamo, Conversica, Datalog.ai, Elafris, Nuance Communications, Pack’n Drive, Pypestream, Reply.ai, SaleMove, Spixii, and Tata Consultancy Services. It is based on 12 interviews with executives at some of the leading chatbot providers, including providers in North America, Europe, and Asia.

This 29-page Impact Note contains four figures and two tables. Clients of Aite Group’s Life Insurance, Health Insurance, or P&C Insurance services can download this report, the corresponding charts, and the Executive Impact Deck.