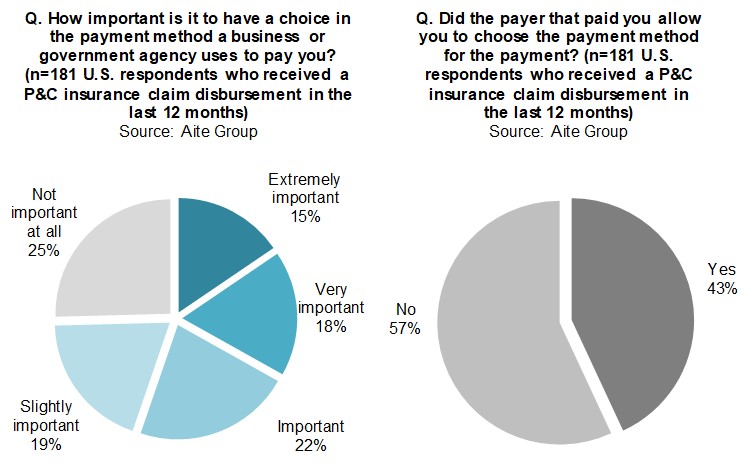

Boston, October 30, 2019 – Once P&C insurance carriers have ensured that any claim payout is not greater than necessary, the fund handover is anticlimactic, with most carriers either sending physical checks or empowering local adjusters to cut checks and deliver them to payees. But plenty of evidence suggests that U.S. consumers would be more than amenable to receiving claim disbursements through means other than a paper check.

This Impact Report digs into data that summarizes a few of the key points that support the contention that alternatives to traditional claim payment disbursement options can be employed by P&C carriers and can be accepted by consumers. It is based on a Q2 2018 Aite Group and Ingo Money survey of 2,538 U.S. consumers aged 18 years or older who received a funds disbursement in the 12-month period from June 2017 to May 2018.

This 21-page Impact Report contains 13 figures and five tables. Clients of Aite Group’s Retail Banking & Payments or P&C Insurance service can download this report, the corresponding charts, and the Executive Impact Deck.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.

Other Authors

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.