BPO Bounces Back: Investment Operations Outsourcing With U.S. Global Custodians

Report Summary

BPO Bounces Back: Investment Operations Outsourcing With U.S. Global Custodians

The business process outsourcing business is bouncing back, but an understanding of previous failures is resulting in radically different operational structures.

Boston, MA, August 10, 2009 – A new report from Aite Group, LLC examines investment operations outsourcing - the core operational infrastructure of asset management and hedge fund firms. The report identifies key trends in the outsourcing market and profiles the business process outsourcing (BPO) services provided by four U.S. global custodian firms.

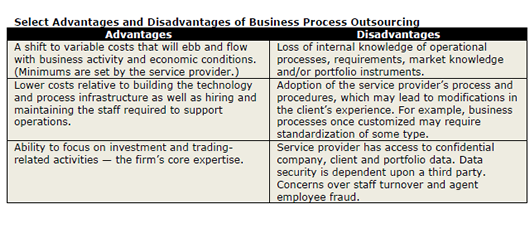

Earlier in this decade, demand for BPO (aka investment operations outsourcing) slowed. Reversals of lift-outs made headlines as some asset managers brought operations back in-house. Firms on both sides of the contract were disillusioned by poor communication, vague SLA metrics, lack of asset manager oversight, and client fixation on cost reduction. Today, the market crisis is resurrecting a need for self-assessment by investment firms as they manage a business with deteriorated portfolio values, difficult capital markets and demanding investors. Can outsourcing help firms achieve their objectives? Asset managers and hedge fund firms are evaluating investment operations outsourcing, and new expectations and understandings on the part of the buy-side firm and the service provider are leading to new operational structures.

"The business process outsourcing business is bouncing back, but an understanding of previous failures has resulted in a radically different environment," says Denise Valentine, senior analyst with Aite Group and author of this report. "This decade offered a tremendous learning experience to service providers and clients alike. Providers are more willing to walk away from a potentially unprofitable deal, and have developed a new caliber of skilled staff and business process improvements through their experience curves and the latest technology. Asset managers are more adept at communicating their expectations and are more comfortable with outsourcing than ever before."

The report provides market sizing and a comprehensive list of services offered by BNY Mellon Asset Servicing, Citi Global Transaction Services, JP Morgan Worldwide Securities Services, and Northern Trust Global Fund Services.

This 53-page Impact Report contains 10 figures and 17 tables. Clients of Aite Group's Institutional Securities & Investments service can download the report.