Boutique Asset Management: Leveraging Technology to Successfully Streamline

Report Summary

Boutique Asset Management: Leveraging Technology to Successfully Streamline

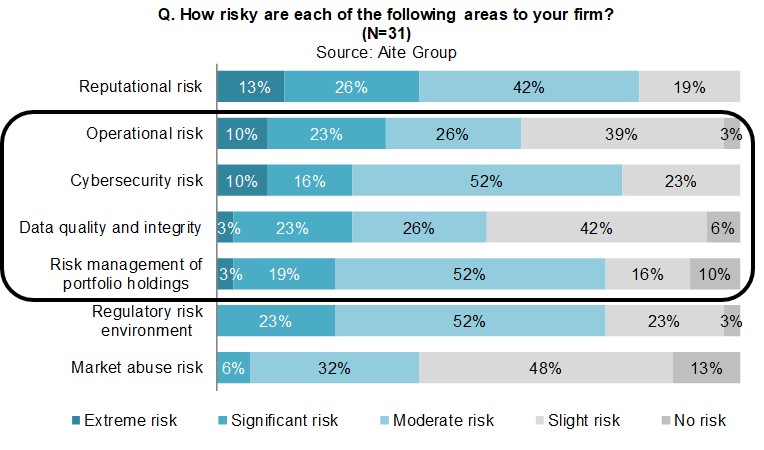

Boutique asset managers can support challenging risk management areas by upgrading platforms and streamlining operations.

Boston, January 17, 2018 – Boutique asset managers are poised to capitalize on the resurgence of investor interest in actively managed investments. A key driver of this rebound, however, is the active management industry’s ability to reduce fees in order to compete with passive counterparts. This will require active asset managers to streamline their own operational costs—a process in which their technology strategies must play a role.

This report explores current technology trends, key challenges and risks, and technology investment plans for the boutique asset management industry. It is based on 31 interviews Aite Group conducted during Q4 2016 with senior executives or managers at boutique asset management funds from around the world. It is the second report in Aite Group’s boutique asset management series; find an introduction to the boutique asset management industry here.

This 25-page Impact Report contains 19 figures. Clients of Aite Group’s Institutional Securities & Investments service can download this report, the corresponding charts, and the Executive Impact Deck.