Asset Management Business and Technology Priorities: Survey 2009

Report Summary

Asset Management Business and Technology Priorities: Survey 2009

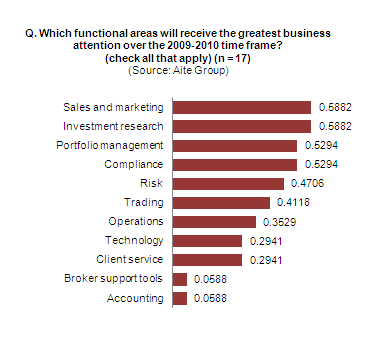

Business priorities for 2010 emphasize sales outreach, attention to supporting and enhancing the investment process, and risk mitigation through systems and/or process improvement.

Boston, MA, September 14, 2009 – A new report from Aite Group, LLC analyzes business priorities and challenges, technology initiatives and budget expectations for the asset management market over the next two years, as well as the degree to which investment operations outsourcing is being utilized to further business goals. The report is based upon a summer 2009 Aite Group online survey of global and U.S. asset managers.

Most economists and regulators theorize that the 2008-2009 market crisis will continue into 2010. The asset management business will labor on under this shadow, attempting to rebuild client asset values, and carefully selecting projects that will enhance direct client value, investment management support and risk mitigation. As of mid-2009, there is still enough market volatility to give investors pause, and the U.S. Congress and European legislatures are considering regulations that will bring greater controls and transparency to the capital markets. Business priorities for 2010 emphasize sales outreach, attention to supporting and enhancing the investment process, and risk mitigation through systems and/or process improvement. Trading systems and tools continue to dominate the technology scene for asset managers of all sizes.

"Asset managers and hedge fund firms will approach the balance of 2009 and much of 2010 with a continued conservative stance," says Denise Valentine, senior analyst with Aite Group and author of this report. "There will be a wait-and-see period during which firms - eager to keep clients and staff - will buy only what they absolutely need (from technology to acquisitions), expand only where they feel ultra-confident and well-researched, and focus only on internal products, processes and people to gain momentum for the recovery."

This 21-page Impact Note contains 19 figures. Clients of Aite Group's Institutional Securities & Investments service can download the report.