Boston, November 24, 2021 –One of the riskiest activities a lending financial institution can undertake is commercial lending: the extension of large amounts of credit to a large number of borrowers with complex transactions. This is even more important during a crisis, such as an economic downturn or natural disaster—a pandemic, for example. Worthy of analysis, then, is the mid-pandemic state of commercial lending, including the degrees to which automation has improved it and the degree to which senior managers have turned to automation to steady the commercial lending ship through the COVID-19 pandemic storm.

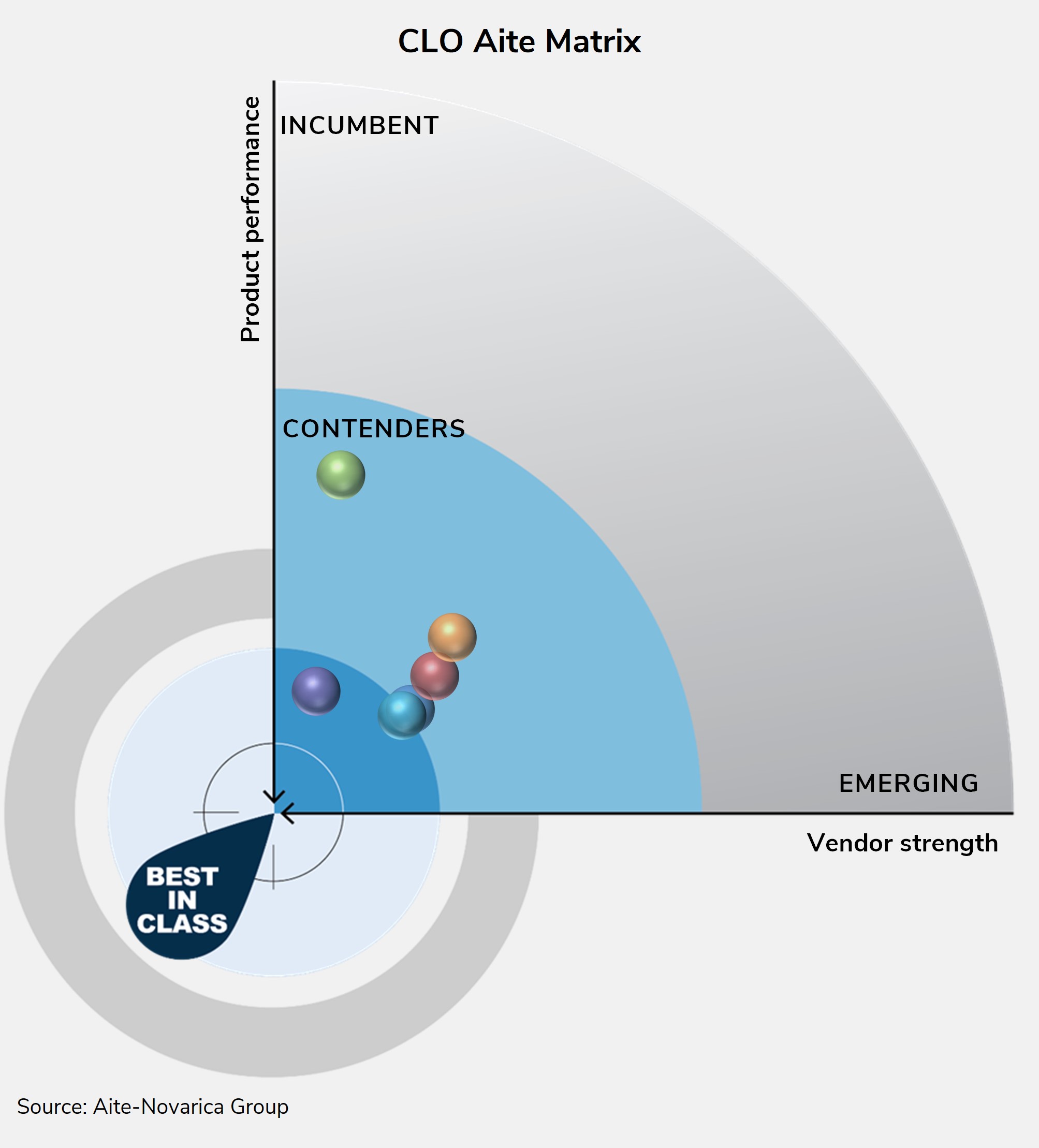

Leveraging the Aite Matrix, a proprietary Aite-Novarica Group vendor assessment framework, this Impact Report evaluates the overall competitive position of six vendors, focusing on vendor stability, client strength, product features, and client services. This report profiles Abrigo, Baker Hill, Finastra, Moody’s Analytics, nCino, and Q2 as part of the Aite Matrix framework. Jack Henry & Associates is also profiled.

This 111-page Impact Report contains 31 figures and 32 tables. Clients of Aite-Novarica Group’s Commercial Banking & Payments service can download this report and the corresponding charts.

This report mentions Axe Finance, Biz2Credit, Blooma.ai, FIS, Global Wave Group, Intellect Design Arena Ltd., Linedata, Loxon Solutions, Nucleus Software, Numerated, Oracle, Sopra Banking, and Temenos.

About the Author

David O'Connell

David O’Connell is a Strategic Advisor with the Commercial Banking team at Datos Insights, where his primary coverage area is lending. A former commercial lender of 14 years, David brings to his lending coverage extensive hands-on and granular knowledge of banks’ challenges in building businesses that lend safely, cost-effectively, and at scale. Broadly scoped, David's coverage of lending encompasses the...