Banking and other financial institutions (FIs) are racing to replace their legacy core platforms with new systems to accelerate the transformation to digital 24/7 banking, from any software platform, anywhere, and on any device. To fully realize the benefits of a new core banking platform and minimize risks to the organization, IT leaders should structure implementation within enterprise architecture (EA) considerations.

Banking and other financial institutions (FIs) are racing to replace their legacy core platforms with new systems to accelerate the transformation to digital 24/7 banking, from any software platform, anywhere, and on any device. To fully realize the benefits of a new core banking platform and minimize risks to the organization, IT leaders should structure implementation within enterprise architecture (EA) considerations.

A reference architecture to guide core platform replacement modernization is vital; my new research brief dives into how a best practices architecture facilitates successful implementation in meeting both strategic business and compliance-related objectives. I’ve summarized some key takeaways below.

The Reference Architecture Imperative

Implementation of a new core platform in the absence of guiding EA principles and best practices leaves FIs vulnerable to non-trivial risks like regulatory fines and underperformance in meeting customers' digital banking expectations.

In a recent blog post, I wrote, “As new technology brings with it novel risks, the stakes feel ever higher for institutions reliant on homegrown systems.” To fully realize the benefits of a new or modernized core platform, like more powerful analytics and a unified customer-facing digital experience, embedding the new core platform into a reference architecture is essential.

It’s not the traditional architecture blueprint or process that is required here; instead, the reference architecture should be based on best practices like zero-trust and accommodate key elements in the organization’s technology roadmap like APIs and cloud technologies. By aligning the core system implementation with a best practices reference architecture, FI CIOs and CTOs are ready to lead a strategic initiative that addresses the primary challenges confronting legacy platforms.

Six Considerations for New Core Systems

IT leaders in FIs aim to meet two objectives when implementing a new core banking system: achieve the desired strategic technology and business objectives of a core system replacement and deploy the new platform and other core solutions in alignment with Federal Deposit Insurance Corporation (FDIC) guidelines.

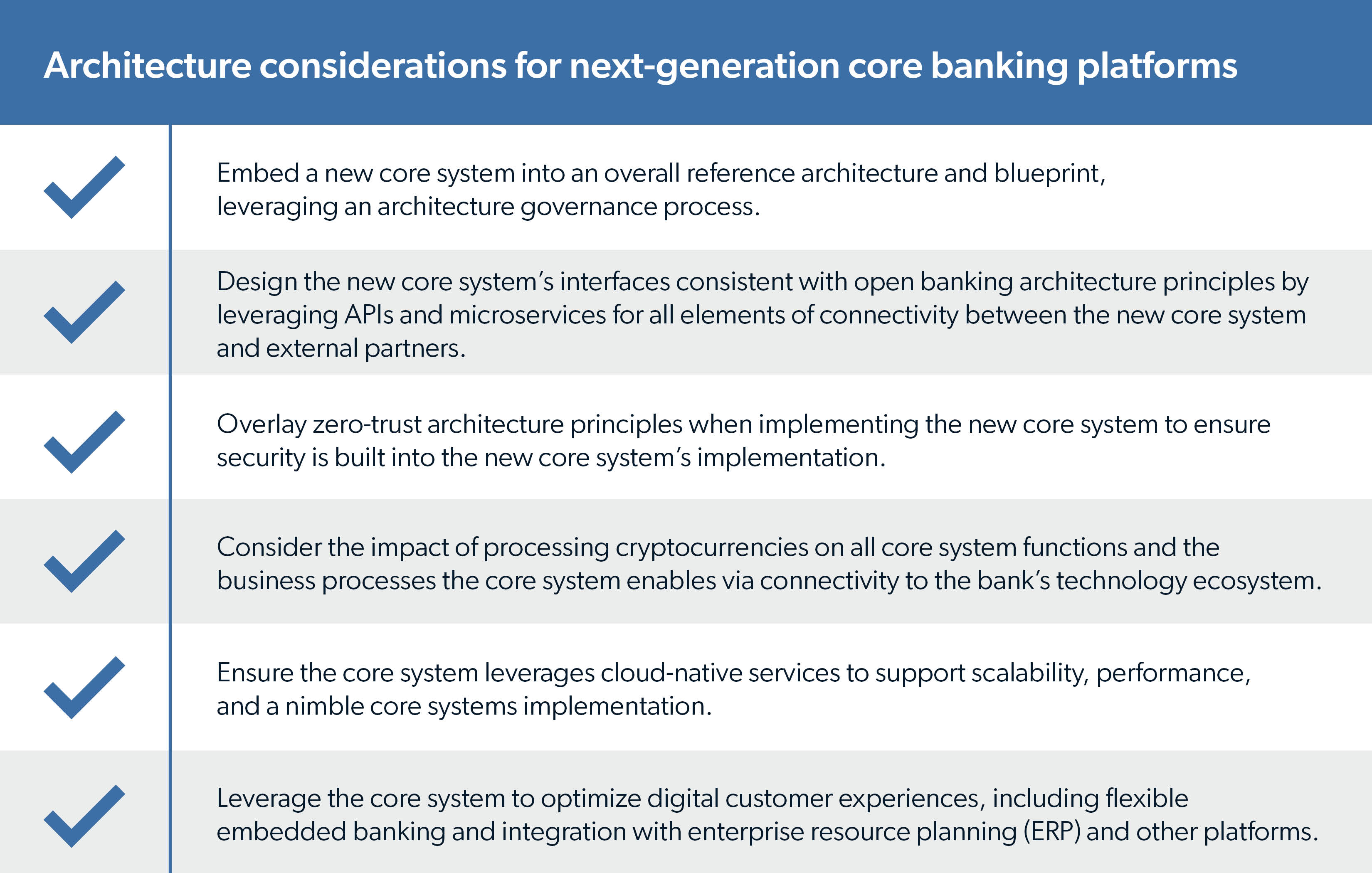

When replacing a legacy system, CIOs and CTOs should embed the new system in a reference architecture framework that adheres to FDIC guidelines as well as encompasses best practices. My new brief titled CIO Checklist: Architecture Considerations for Next-Generation Bank Core Platforms articulates six considerations that should be used to evaluate and refine the reference architecture blueprint and principles before any core system replacement is initiated.

Together, these considerations constitute best practice guidelines to lead implementation of a new core platform that supports achieving strategic business objectives (e.g., 24/7, on-demand financial transactions) and enables delivery of modern customer experiences while maintaining regulatory compliance.

How Architecture Enables Successful Implementation

The success of core platform modernization/replacement initiatives is contingent on leveraging a best-in-class EA plan in the context of realizing the organization's future-state technology blueprint.

Highly effective architecture plans are comprised of three main elements including a target reference architecture that is essential for integrating the replacement or modernization of core systems and other aspects of transformation, such as APIs. It's also crucial to consider how a new core system implementation affects other IT projects by assessing whether projects underway should get cancelled or accelerated and if new projects to augment the new core system should be kicked off.

FI CIOs and CTOs should also prioritize determining if Agile development—an increasingly common methodology in functions like software product development and digital transformation—will be adopted to implement the new core system. In Agile methodology, architecture teams must shift to an approach emphasizing collaboration with the technology teams through consultation and reference architecture tools.

As banks and traditional FI organizations continue advancing the digitalization of their product and customer service models, it is imperative to replace and modernize legacy core platforms. Reliance on EA best practices, such as embedding the new core system into an overall reference architecture and blueprint, is the key driver of successful implementation and achieving meaningful progress in 24/7 banking.

An Invitation for You

Interested in learning more about our latest insights on architecture best practices for core systems modernization? Would you like to help steer the strategic research and best practices we deliver to CIOs, CTOs, and Heads of Architecture by joining our exclusive Financial Services CIO/CTO Research Council?

Research Council members get free access to a subset of the new research we will deliver to executives who join our new Financial Services CIO/CTO Advisory Practice. Membership is anonymous, and participation in any particular survey or meeting is completely optional.

Join the conversation on May 24 at our next CIO/CTO Research Council meeting for Charter Advisors.

>> Email me, and I’ll contact you to schedule an introductory conversation on our Financial Services CIO/CTO Advisory Research Council and send you a complimentary copy of our brief, CIO Checklist: Architecture Considerations for Next-Generation Bank Core Platforms.

Add new comment