Last week, Novarica was the keynote sponsor of the InsurTech Hartford Symposium. I had the honor of moderating a great panel discussion between Doug Alexander of AXA XL, Will Lee of Hanover, John Glooch of Nassau Re, and Jill Frankle of The Hartford.

Some of the main themes were protecting innovation, assessing startups, and making it easier for startups to partner with carriers.

Protecting Innovation

Innovation means experimentation, and it can be hard to get a budget approved to spend hundreds of thousands of dollars to potentially fail and get nothing from the investment. Some carriers have “free money to experiment,” and others have found that establishing governance and defining target learning areas can provide guardrails around innovative pilots. Innovation also relies on culture, especially at the executive level. Some insurers are trying to encourage a cultural shift by increasing internal exposure to accelerators and innovation hubs.

The complexity of insurer environments can further hinder the ability for InsureTechs to get up and running and prove value. As one panelist noted, there is a “lot of baggage for startups to come into a carrier system.” Having a sandbox to separate production from testing and learning can lower the stakes of failure and make experimenting easier.

Assessing Startups

Selecting a startup can be a daunting challenge because of sheer volume; one panelist mentioned tracking about 2000 companies. In general, insurers are looking beyond valuation or funding rounds. Insurers are using business problems as a yardstick against which to evaluate startup investments, going after companies that can prove value quickly and cost effectively. Data governance, scalability, and proving that roadmaps are aligned with insurer goals are also paramount. For some it’s a matter of startup responsiveness and whether they’ll take an insurer’s calls.

Making it Easier for Startups to Partner

Partnering with startups looks very different from licensing incumbent vendor solutions. Many InsureTechs won’t understand the business of insurance or the technology environments that they’re entering. Some insurers are addressing this educational gap through mentorship and coaching. Others have shortened existing contracting processes. Even so, many will still expect InsureTechs to undergo an extensive security review. This process may certainly be a strain on startups’ limited funding and resources; however, it is also a good exercise for InsureTechs in getting up to speed on regulation and security.

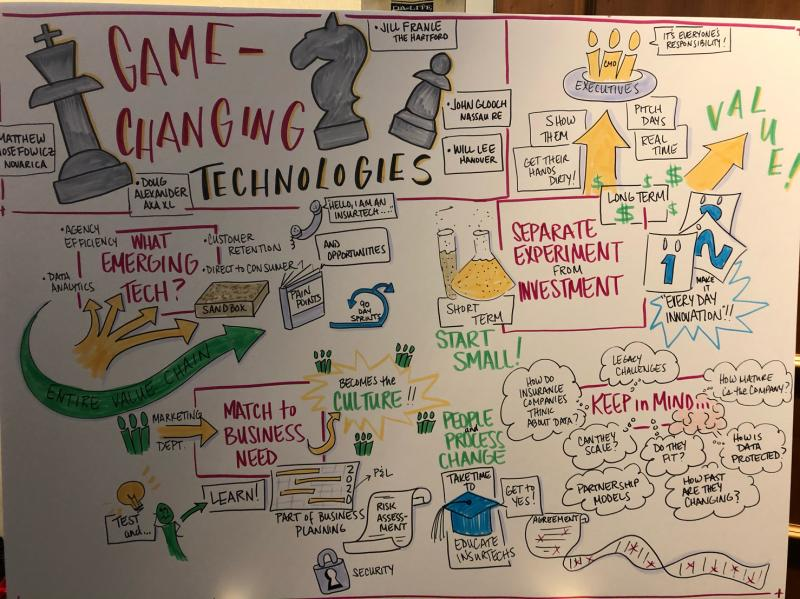

Our conversation was captured in an image by Kim Dornisch.

For more on emerging technology and innovation see Novarica’s recent reports on insurer investments and the InsureTech landscape. For more about our research and advisory services for insurers related to innovation, please contact us at [email protected].

Add new comment