Last month, my colleagues Deb Zawisza and Paul Legutko joined me in hosting the Workers’ Compensation Special Interest Group. We discussed insurers’ top priorities for 2021 and beyond, revealed in Aite-Novarica’s latest Business and Technology Trends: Workers’ Compensation report, and further addressed workers’ compensation payment trends and customer experience.

Last month, my colleagues Deb Zawisza and Paul Legutko joined me in hosting the Workers’ Compensation Special Interest Group. We discussed insurers’ top priorities for 2021 and beyond, revealed in Aite-Novarica’s latest Business and Technology Trends: Workers’ Compensation report, and further addressed workers’ compensation payment trends and customer experience.

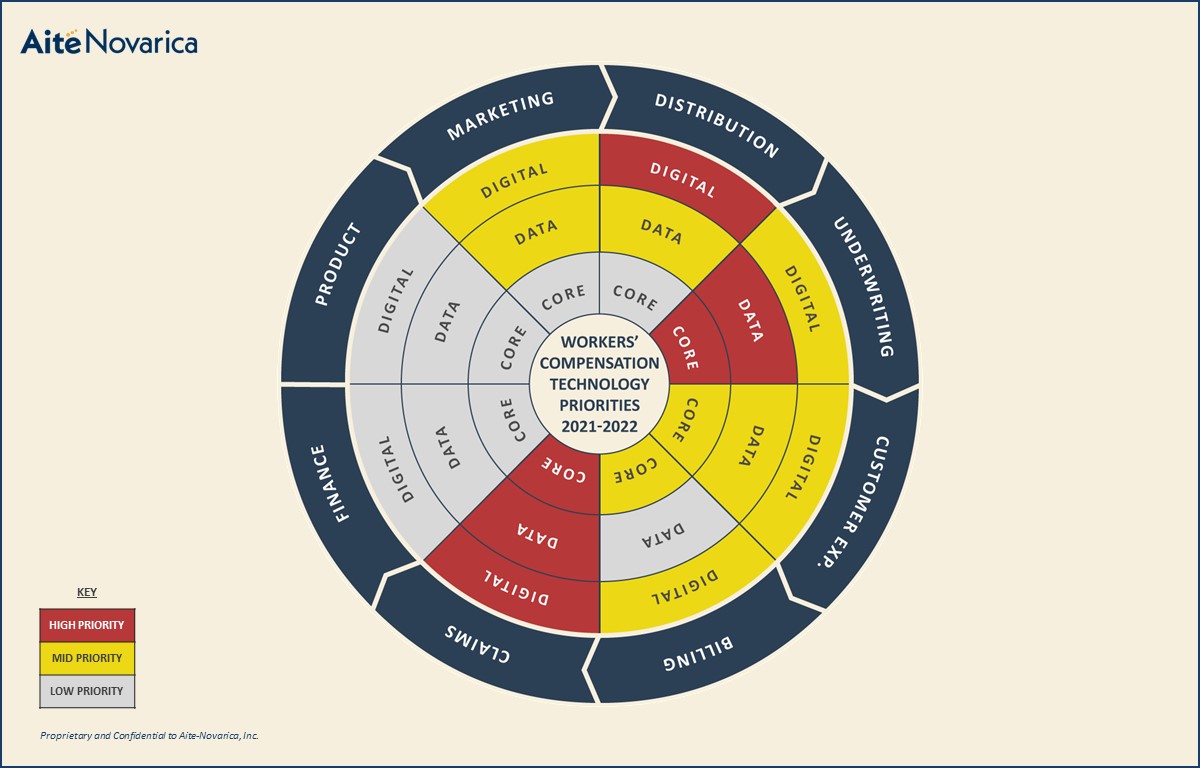

As shown in the heat map below, workers’ comp insurers are prioritizing digital capabilities to improve ease of doing business with agents, policy system initiatives, data capabilities for underwriting, and claims technologies to optimize the complex claims processes associated with workers’ comp.

The impact of COVID-19 was significant to the space, but many insurers have returned to their pre-pandemic priorities and have weathered the storm relatively well. Many of the meeting’s participants are in the process of transforming their policy systems, and most also plan to focus on digital capabilities in 2022.

Insuretech Capabilities

Like many other lines of business, workers’ comp insurers are investing in insuretech capabilities available in their claims ecosystems. Workers’-comp-specific insuretech startups are offering robust capabilities around data aggregation, integration and presentation, claims predictive models, aerial imagery, image analysis, IoT, and more.

Insurers with a sound claims system can leverage these insuretech capabilities to optimize claims processing efficiency, reduce losses, and improve policyholder and injured worker satisfaction. Most meeting participants run a modern claims solution and are engaged either in production or engaging in pilot projects with emerging tech providers or newer insuretech startups.

Digital Payments

Insurers have started to invest considerably in digitization of both inbound and outbound payment processes, with a shift toward greater automation and variety of channels for providing payments. The pandemic has accelerated insurers’ interest in transitioning to digital payments. Key trends in workers’ comp payments include leveraging virtual cards and enhanced options for medical provider payments.

Many insurers are taking advantage of payment partners that offer enhanced services for payment and customer service to healthcare providers. Many payment gateway providers are teaming up with core solution providers to provide pre-integration with their systems and gain a more significant part of the market.

Pay-as-You-Go

More and more businesses are turning toward the pay-as-you-go method for workers’ comp billing due to the financial challenges caused by the COVID-19 pandemic. This concept assisted businesses as their payroll fluctuated and staffing dropped. It also aided policyholders in not having to pay estimated payments and getting returns from an audit perspective.

Pay-as-you-go decreased operating expenses substantially and was particularly useful to small and medium-sized businesses as the pandemic compelled businesses to be agile in their approach. Participating insurers agree that pay-as-you-go will continue to gain momentum as startups begin to accelerate once again.

Customer Experience

Insurers have realized they are in the business of selling experiences as much as products; they need to think about customer experience in addition to the core insurance product. Data can personalize an experience in real time and be leveraged to match communication channels with consumers’ preferences.

Customer experience should be aligned with the market segment needs and address omnichannel, not just digital—including every and any point of interaction between the user and the brand. Online chat, text messages, and even physical mail are examples of omnichannel communication. Due to demand from users and data connectivity, we are witnessing a more significant push toward providing a positive experience to users.

Numerous organizations noted that they have started customer journey mapping to improve the experience of the users. The process of designing a customer journey map helps businesses step into their customers’ shoes and observe how users interact with their products. Insurers are discovering issues to address with prospect, policyholder, agent, and injured worker satisfaction; overall company reputation; and usability of digital capabilities. Journey mapping has helped them understand consumers’ attitudes on a personal level.

We’re looking forward to the next meeting of the Workers’ Compensation Special Interest Group as part of our Insurance Technology Research Council Meeting in Providence on April 8, 2022. To learn more about the Insurance Technology Research Council, please click here. To further discuss trends in workers’ compensation, feel free to reach out to me at [email protected].

Add new comment