In the last 48 hours, three of the four largest discount brokerages have cut their commission charges on trades to zero. Combined, Charles Schwab (who commenced the expedition to zero), TD Ameritrade, and E-Trade have US$2.35 trillion retail client assets and over 28 million brokerage accounts. Thus, the switch to zero commission by these three firms enables the majority of U.S.-based clients engaged with retail brokerages to now use their services for free.

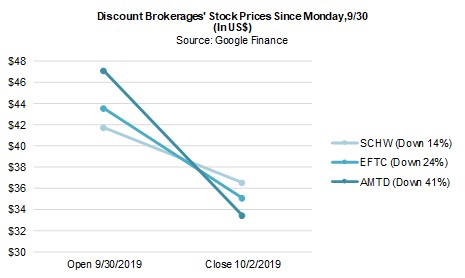

Commission prices have been falling for years. In fact, lower commission prices were at the genesis of the discount brokerage industry. Aite Group has been covering what some call “the race to zero” since 2005 when the report “The Death of Discount Brokerage” was published. The downward trend has elicited change among the discount brokers as they have focused on diversifying their revenue stream, with varying success. Approaches to diversification include adding fee-based investment advisory services operated through call centers and brick-and-mortar offices scattered across the U.S. Additionally, these firms have implemented robo-advice platforms that charge clients a fee based on assets under management (AUM). Despite these changes, investors this week were not convinced there has been success in diversification across the board. While all three stocks sold off quickly this week, some fared worse than others, as shown in the following figure.

The differences in the stock price percentage declines as shown in the graph above are distinct. So why did TD Ameritrade (AMTD) decline 41% while Schwab (SCHW) declined only 14%? One possible explanation is that the reliance on commission revenue from trading relative to total net revenue is higher for TD Ameritrade compared to Schwab. Schwab has much less dependence on commissions because of the revenue diversification efforts put in place and executed upon successfully over the years. The firm doesn’t even refer to itself as a “discount broker,” but instead, a full-service wealth provider. One of the most recent steps in this diversification process has been the implementation of an innovative subscription-based financial planning service, Schwab Intelligent Portfolios Premium. The firm announced in a press release in July 2019 that the monthly subscription model had added US$1 billion in AUM in just over three months since being open to the public. Another example of Schwab’s commitment to diversification also came in July 2019, when it was announced that Schwab acquired USAA investment management, which includes brokerage and managed portfolio accounts. This evolution to more sustainable revenue sources is the root cause for the dampened decline in SCHW compared to AMTD. It is this evolution that has created the gap in commission revenue as a percentage of total net revenue between the firms, as reported in their regulatory filings:

- Charles Schwab: 7%

- E-Trade: 17%

- TD Ameritrade: 36%

So, what is next for these firms?

We see this as, fundamentally, a client acquisition strategy through the “freemium” model of free entry for clients followed by upselling opportunities. What matters for the discount brokers here is whether cutting commissions to zero drives more clients to create and fund brokerage accounts on the respective platforms. Once the client is engaged with the firm, the focus can then turn to servicing the needs of the client as they arise. Perhaps advisory services are needed during major life events, or maybe the client discovers the need for financial planning services; all of which are revenue generators and also valuable for clients. The key is to have clients on-hand and engaged. Once the clients are engaged, offering adjacent services is possible, given that the firm will have a relationship and, importantly, data on the client to analyze and then determine prescriptive revenue-generating offerings.

Though, at this point, with nearly all the major discount brokerages at zero, it is hard to decipher if any of the dynamics have changed between the firms. Will this attract new clients to the firms? What will be the motive for new clients to sign on, given that all firms offer free trading? Finally, will this be the catalyst for more mergers and acquisitions that will reshape the discount brokerage landscape?

Add new comment