Global recession woes, climate change, and frayed political landscapes continue to test the financial services industry. As a result, financial institutions (FIs) are pressured to balance stability with growth, manage evolving consumer expectations, and keep up with technological advances while acknowledging the changing world around us.

The survival of FIs and the vendors that work with them depends on quick recalibration and even quicker action. As we head into the coming year, these organizations will need to adapt to issues like climate change, customer expectations for omnichannel experiences, and new technology like the metaverse.

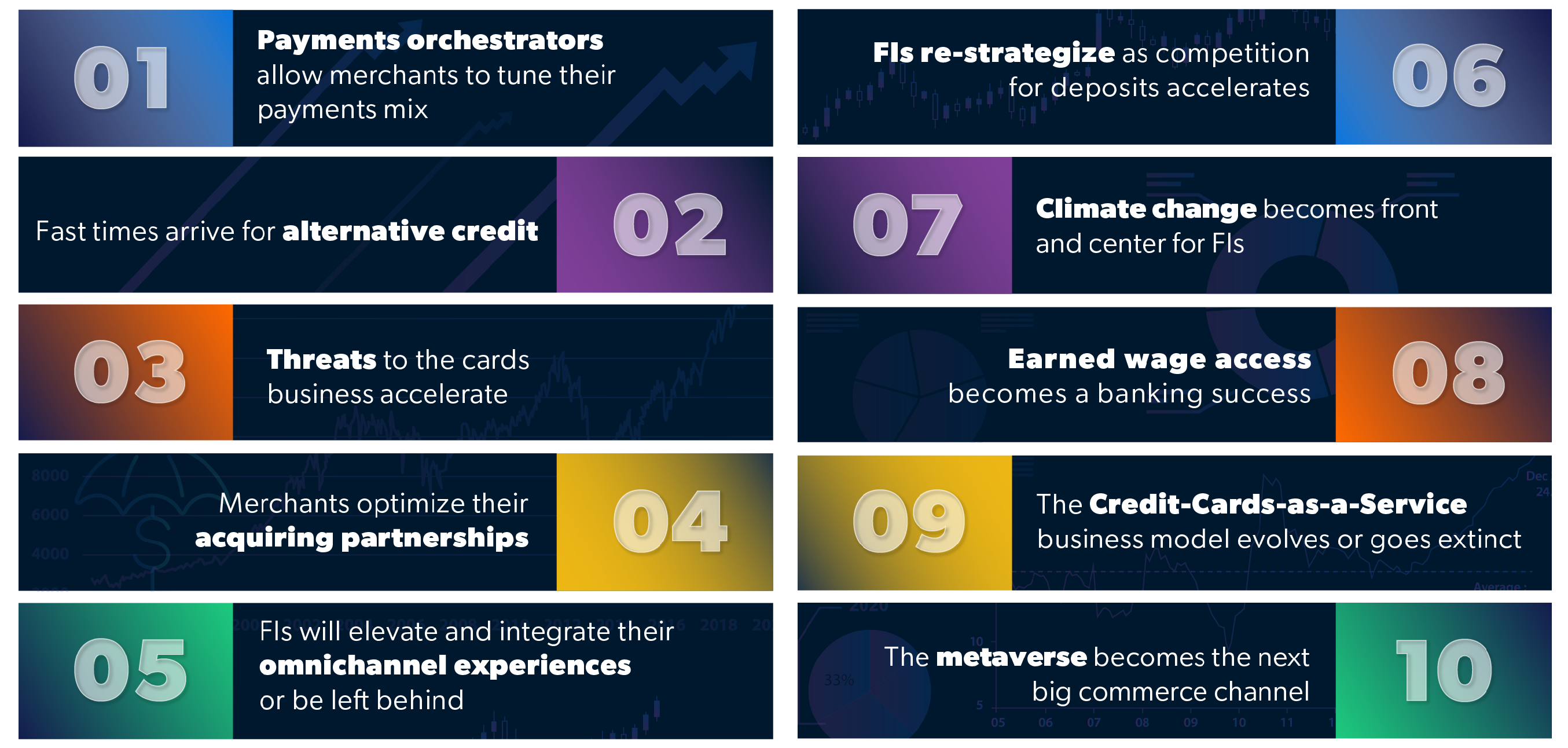

Aite-Novarica Group has identified 10 trends that will shape retail banking and consumer payments around the globe in 2023 and beyond.

Some of these include:

- Payments orchestrators allow merchants to tune their payments mix: Merchant payment acceptance will continue to be a complex challenge, and complexity will only increase over time. Fortunately, new types of processors have emerged to help merchants with this problem. Expect to see the payment orchestration category of processors grow significantly in 2023 and 2024.

- Fast times arrive for alternative credit: Increased consumer demand, greater regulatory scrutiny, and a tough economic environment will make for a tumultuous year for alternative credit, particularly BNPL. Unless providers assist consumers in tracking their obligations and educate them on the hazards of overextension, the year will not fare well for many.

- Threats to the cards business accelerate: Alternative payment types hoping to replace card transactions have never been higher as merchants and billers look for lower-cost payment options. Not only will existing payment alternatives remain strong, but new competition will also come online. Although cards are sure to maintain a leadership position through 2023, they may give up some volume to these growing threats.

- Climate change becomes front and center for FIs: There are few green banking initiatives in the market today, yet consumer demand will rise in 2023. Fintech firms will undoubtedly make a green play for market share in 2023, and smart FIs will take advantage of this green opportunity to become embedded at the center of a consumer’s life.

Retail banks must ensure the right balance between self-service and the human touch, or they will be left behind. While not all of the challenges FIs will face in 2023 are new, they are certainly areas to pay attention to in the year ahead.

To learn more about all 10 of these trends, read our full report Top 10 Trends in Retail Banking & Payments, 2023: Balancing Stability and Growth Amid Economic Volatility or reach out to me at [email protected]. You can also watch the recording of our January 24th webinar where we dove into each of these top trends in detail. Click here to access the recording.